Market Facts: Industrial Robots

07/31/2013 //

Industrial robots are a common sight on the factory floor, particularly in automotive markets. They offer high-precision handling and speed, and reduce operator risk, such as worker exposure to hazardous materials, and to production dangers in general. In the near future, industrial robots will include those that cooperate with humans, instead of replacing them. This will open up new potential for utilizing robots in factories and in the agricultural market, as well as for domestic purposes.

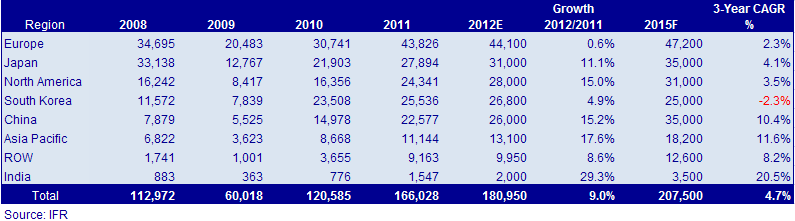

A record number of industrial robots were sold in 2011, with a worldwide increase of 38% over 2010, reaching 166,000 units. The automotive and metal industry largely drove this growth. In the automotive market, sales of industrial robots increased by 55% over 2010, to 59,700 units. In the metal sector, growth in 2011 was 54% and sales reached 14,100 units. In China growth reached almost 51%, followed by the US with 49% and Germany with 39% growth over 2010. For 2012 the IFR estimated a more modest growth of 9.0% over 2011 (see table).

Worldwide Sales of Industrial Robots 2008 – 2015

Number of Robots (units) per Year by Region

To date, Europe, led by Germany, along with Japan, dominate the robot market, closely followed by the U.S. and South Korea. These countries are highly industrialized and still have a large domestic automotive market for industrial robots. South Korea has been the fastest-growing market in recent years, although growth is now leveling off. China is poised to become the single-largest industrial robot market by 2015.

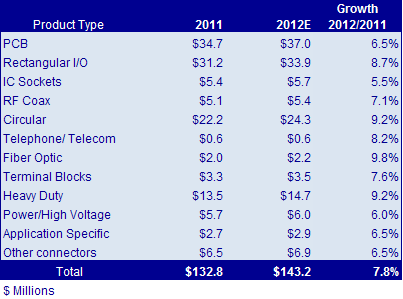

Industrial Robot Makers

The demand for connectors and cable assemblies for the robotics market has increased dramatically due to the surge in this sector’s growth. The average price per industrial robot has decreased over the past five years, by almost 7 to 7.5% per year, and reached levels around $51k in 2011. Connector content in terms of US$ value will likely decrease in absolute value but as such remain fairly stable as percentage of the total cost of an industrial robot. Combined with much higher production numbers, this represents a substantial connector potential for connector manufacturers. The IFR expects sales to reach well over 200,000 units by 2015. In 2011 total robot sales would translate to an estimated $132.8 million connector market. The use of specific connectors designed for industrial robots combined with more general technology trends in the automation market will also influence the connector mix used in industrial robots, such as the increased use of fiber optic connections.

Estimated Connector Sales Industrial Robots 2011, 2012

Cable Assemblies and Flex Cable Solutions

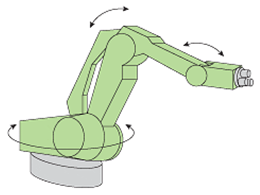

Due to the dynamic nature of an industrial robot and its requirement to move around multiple axes, specification, equipment design, and proper installation of specific cable assemblies is essential. Depending on the type of robot and the required movement, speed, and flexibility, the following checklist may help to select the proper cable.

Basic Robot Movements: Bending, Sliding, and Twisting

© Courtesy of OKI

Cable Assembly Checklist for Industrial Robots:

- Motion requirements for the robotic cables: twisting and rotating

- Bending and bend radius

- Maximum travel and slide

- Speed (m/sec) and acceleration (m/sec²)

- Number of cycles per day and operational days per year

- Cable voltage and other electrical characteristics (i.e. impedance, capacitance, attenuation, shielded)

- Cable temperature range (high/low temperature-resistant)

- Chemical resistance and environmental characteristics, e.g. flame-retardant, UV-resistant, halogen-free, abrasion-resistant, impact-resistant, tear-resistant, oil-resistant, etc.

Not only are cable assemblies an important part of the design of a robot, but cable wear can be a primary source of downtime on a robot work cell. Therefore it should be engineered during, and not after, the initial design process of the work cell/robot, so design engineers can take into consideration all operational aspects of the robot as mentioned in the above checklist.

Manufacturers have developed cables specifically for the torsional movements that meet the high mechanical performance required for robot applications, where repetitive flexing in multi-axes systems is required. But there is another trend in the market toward less cabling. To avoid system designers and end-users getting tangled up in the world of cables and cable specs, it is no surprise that many users are looking for more wireless technology in industrial robots. Although wireless technologies are already widely used in factory automation applications, it will be a while before they become mainstream in robot applications. Robots have no margin for error when it comes to their dynamics and safe operation.

Manufacturers are also developing so-called “smart” cables. These cables have some embedded intelligence, informing end-users when there is too much tension or when cable fatigue has set in, so preventive maintenance can be scheduled to avoid downtime.

No doubt more developments and innovations in cable assemblies specifically designed for robot systems are on their way. With a growing worldwide market for industrial robots, the cabling issue will be further scrutinized and new investments will be made to develop even better cabling systems that ensure even better industrial robot performance.

Conclusions

With China, South Korea, and the rest of Asia Pacific representing an estimated 40% of the industrial robot market by 2015 — coming from 24% in 2008 — it is clear that the potential for this growing market is shifting at high speed to this region. Despite this trend, the markets in Europe, Japan, and North America remain equally important, as these industrialized countries continue to increase the level of automation in their manufacturing plants in order to remain competitive in the global markets. For connector manufacturers, this means a well-balanced sales strategy targeted at the major industrial robot makers and their end users is poised to produce satisfying results over the coming years.

Ronald E. Bishop

Ronald E. Bishop founded Bishop & Associates Inc., a market research firm that specializes in the world electronic connector industry, in 1985. The firm publishes a monthly newsletter titled “The Bishop Report,” and the twice-monthly digital publication Connector Supplier.

The reports, produced by a staff of 20 researchers, focus on geographic regions, end-user equipment markets, connector products, and interconnect technologies.

The firm also provides executive placement services and conducts multi-client studies and customer surveys, and assists in merger and acquisition activity.