Market Update: Commercial Aviation

08/11/2016 //

The worldwide demand for commercial airliners is booming. In 2015, Boeing and Airbus combined built a total of 1,397 aircraft. According to the Wall Street Journal, both companies are putting in automation on their production lines, from robots to exoskeletons for the workers, to increase their output. They intend to increase their unit volume production by about 33% each year until 2020 to reach a combined output of 1,800 planes per year (an average of 150 planes per month). They are each currently producing an average of 58 planes per month.

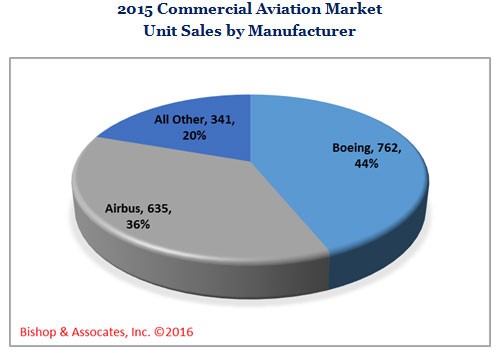

Boeing is the largest producer of commercial aircraft. By unit volume produced and delivered, they hold 44% of the market followed by Airbus at 36%. Other manufacturers include Bombardier and Embraer, who manufacture regional jets, UAC from Russia, and Comac from China. Comac’s regional jet is flying, but has not received FAA certification and their C919 narrow body is three years behind schedule.

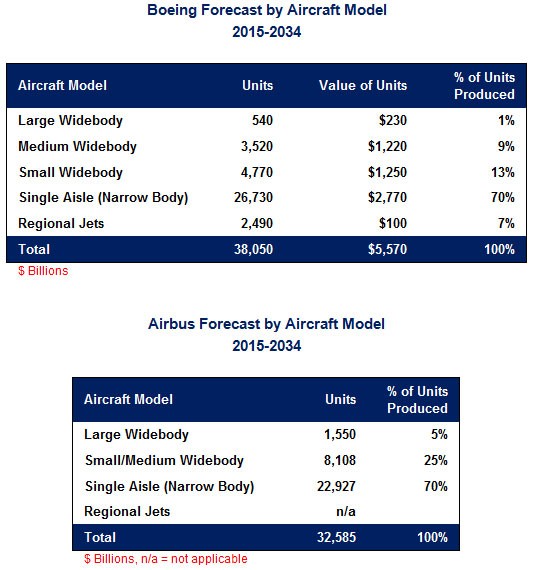

Boeing and Airbus are both forecasting significant demand for their aircraft going out through 2034. The following are the forecasts by each company.

Although not precisely the same, the forecasts from each company are pretty close when you consider that they are 20-year projections. Needless to say, both companies see a good future for their aircraft.

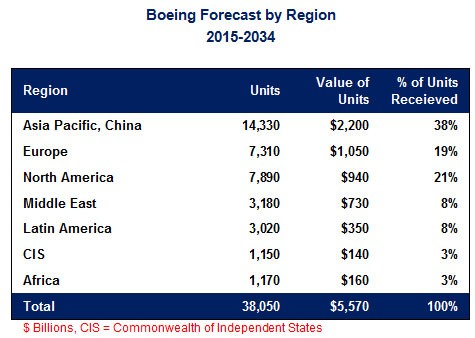

By region, Boeing sees the largest potential for future sales in Asia Pacific/China, garnering 38% of the worldwide market, followed by Europe and North America.

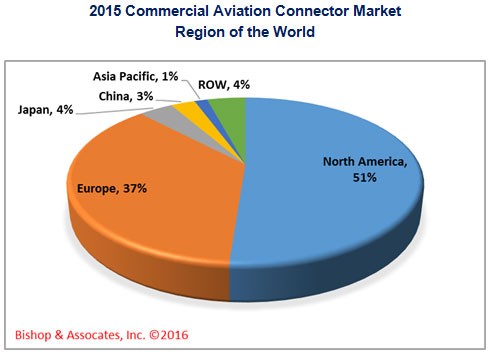

The 2015 market for connectors in commercial aviation was $713 million. Not surprisingly, with Boeing and Bombardier, North America held 51% of the connector market share. Europe held 37% of the share with Airbus.

Some of the major connector companies selling into the commercial aviation market sector include:

- Amphenol – 2015 sales of $5,569 million, reported sales into commercial aviation of 6% of sales (approximately $334 million).

- TE Connectivity – FY2015 sales of $12,200 million of which approximately 8% is in their military/aerospace/marine market sectors (approximately $976 million).

- Souriau – an Esterline Company, had estimated 2015 sales of $299 million. Airbus is a major customer.

- Smiths Connectors – 2015 sales of $641 million, of which $246 million was connectors

- Rosenberger – DIN EN 9100 and MIL-PRF 39012 qualified supplier; 2015 sales estimated at $920 million

- Radiall – 2015 sales of $334 million, of which approximately 69% was reported as military/aeronautics/space market sectors (or $231 million)

- Carlisle Interconnect – 2015 sales estimated at $373 million

- ITT Interconnect Solutions – 2015 sales of $328 million

- Eaton Interconnect – 2015 connector sales of $79 million

- Bel Connectivity – 2015 sales of $339 million

Connector sales in commercial aviation are expected to grow at a compound annual growth rate of 6% through 2021 reaching a value of over $1 billion.

More information can be found in Bishop's market research report, Civil Aviation Market for Connectors, Research Report M-4100-16.

Ronald E. Bishop

Ronald E. Bishop founded Bishop & Associates Inc., a market research firm that specializes in the world electronic connector industry, in 1985. The firm publishes a monthly newsletter titled “The Bishop Report,” and the twice-monthly digital publication Connector Supplier.

The reports, produced by a staff of 20 researchers, focus on geographic regions, end-user equipment markets, connector products, and interconnect technologies.

The firm also provides executive placement services and conducts multi-client studies and customer surveys, and assists in merger and acquisition activity.