Top Ten Gain Market Share

09/23/2014 //

Top Ten Gain Market Share

Collectively, the top ten largest connector manufacturers increased their sales by +4.6% in 2013 versus world industry growth of +2.7%. Total sales of the top ten accounts for 60.4% of world connector demand.

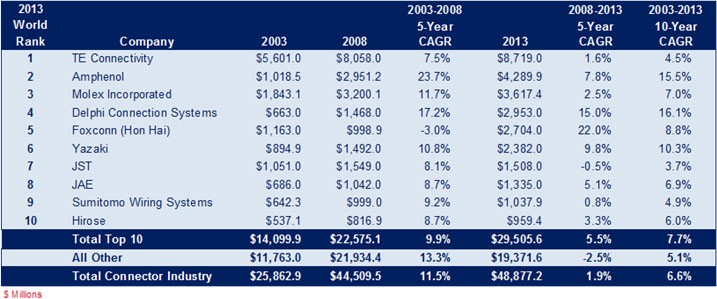

The following table identifies the top ten ranked by total world sales.

Top Ten

2012-2013

Since 1980, when Bishop & Associates began tracking the connector industry, the top ten have steadily gained more share of the market. However, top ten market share gains have not been a straight line up. There are periods when the rest of the connector industry performs better than the ten largest companies.

For example, between 2003 and 2008 companies without a top ten ranking achieved growth of +13.3% while the top ten grew only +9.9%. This generally happens when there is a pause in acquisitions by top ten companies. The following table clearly shows that companies not in the top ten can perform better during certain periods.

The following table shows top ten performances in five year increments, 2003-2008 and 2008-2013. Note how the “all others” achieved better growth than the top ten companies in the 2003-2008 timeframe.

2003, 2008 & 2013 Top 10

With 5 and 10-Year CAGR

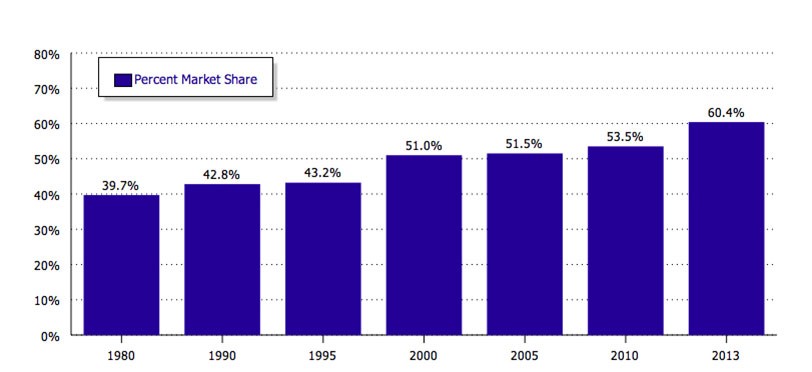

The following chart clearly shows the steady market share gains the top ten have achieved, making the connector industry increasingly top heavy. Top ten companies now account for 60.4% of world connector demand.

Top Ten Share

of World Market

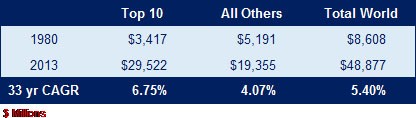

Since 1980 (33 years), the top ten have achieved a CAGR of +6.75% compared to “all others” with a CAGR of 4.07%. That is a huge difference over a 33 year timeline.

33 Year Sales Growth History

1980 – 2013

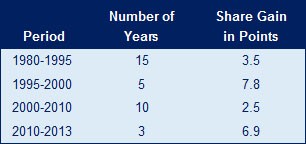

Market share of the top ten has increased steadily, but not in a consistent manner, often occurring in clusters. For example, between 1980 and 1995 (15 years), the top ten gained only 3.5 points in market share, but 6.9 points in market share between the years 2010 and 2013 (3 years).

Top Ten Market Share Gains

Logically the largest companies should gain a larger and larger share of the market over time because large companies have a:

- Broader product offering

- Global manufacturing footprint

- Larger sales and marketing organization

- Larger engineering organization

- Larger customer base

Such resources automatically place these companies on the vendor approval list of most OEMs, which translates into market share gains. However, market share gains attributed to the additional and broadened capabilities of the largest connector companies account for only small, incremental market share gains. The big, meaningful market share gains, of the top ten companies, have come from acquisitions.

As evidence, between the years 2010 and 2013, the top ten gained 6.9 market share points in three years because of the following acquisitions.

TE Connectivity Acquires

2012 – Deutsch

2011 – ADC

Molex Acquires

2013 – FCT

2012 – Affinity Medical

2011 – Luxtera’s Merge Optics

Amphenol Acquires

2013 – Tecvox LLC

2013 – Hangzhou Jet Interconnect

2013 – Ionix Aerospace Ltd

2013 – GE Advanced Sensor (not connectors)

2012 – Holland Electronics

2012 – Griffin Enterprise

2012 – Tel-Ad Electronics

2012 – Nelson Dunn

2012 – Deutgen Group

2012 – FEP

2012 – Cemm Thomas

Delphi Acquires

2012 – FCI Automotive

These acquisitions added approximately $2.5 to $3.0 billion in sales to the top ten companies or between five and six market share points. Hence, acquisitions accounted for most of the 6.9 market share points gained by the top ten between 2010 and 2013.

Market share gains can be achieved through internal growth but significant market share growth comes only from acquisitions, as the top ten performance clearly demonstrates.

Ronald E. Bishop

Ronald E. Bishop founded Bishop & Associates Inc., a market research firm that specializes in the world electronic connector industry, in 1985. The firm publishes a monthly newsletter titled “The Bishop Report,” and the twice-monthly digital publication Connector Supplier.

The reports, produced by a staff of 20 researchers, focus on geographic regions, end-user equipment markets, connector products, and interconnect technologies.

The firm also provides executive placement services and conducts multi-client studies and customer surveys, and assists in merger and acquisition activity.