2015 Connector Industry Forecast

03/16/2015 //

Connector sales grew +8.1% for the full-year 2014 to $52,855 million. Industry growth for 2015 is forecast at +5.1% YOY with sales of $55,569 million.

The following table shows connector sales by quarter for 2013, 2014 and 2015 (forecast). Sales are expected to have a slow start in the first quarter and then gradually ramp up during the year.

Connector Industry Quarterly Sales & Forecast 2013, 2014, and 2015

Sales by region is seen in the next table. China is expected to have the highest growth at +6.6% YOY followed by Asia Pacific at +6.4%.

Connector Industry Actual & Forecast by Region 2014 and 2015

Sales forecast by market sector is shown in the next table. Automotive is expected to have the highest growth at +8.1% YOY, followed by Telecom/Datacom at +6.8%.

Connector Industry Actual & Forecast by Market Sector 2014 and 2015

Industry Breaks Through $50 Billion

The connector industry achieved $52.9 billion in sales in 2014, exceeding $50 billion for the first time. This should have happened much sooner. In 2007, the industry was already at $44.5 billion in sales. Assuming average industry growth, the industry should have cracked through $50 billion in 2009. Instead it required another seven years to break through the $50 billion ceiling. Remember the Great Recession of 2008/2009?

The last seven years (2007-2014) have been difficult, resulting in a CAGR of only 2.5%, which is approximately half of the industry’s 34 year average of 5.5%.

The Difficult Years 2007-2014

Since the great recession of 2008/2009, the industry has been performing much better in both sales growth and industry profitability.

- 2010-2014 CAGR of 8.1%. Three points better than the 34 year industry average of 5.5%

- Price increases implemented in 2010, and subsequent years, have held up. The industry has experienced no price erosion since 2009.

- Raw material costs for gold, copper and plastics have declined from all-time highs.

The effect has been steady growth with slightly higher prices and lower costs. The industry has been very profitable since 2009.

What Next?

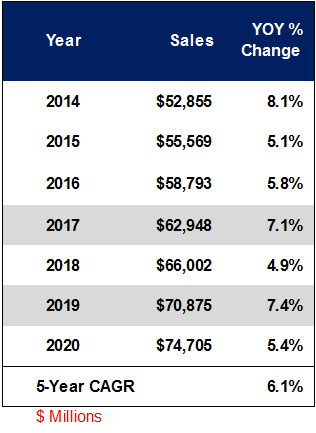

Our outlook for the next six years is continued, but modest, growth. We believe the industry will achieve a 6.1% CAGR through 2020 which is slightly better than the historical CAGR of 5.5%.

Six Year Outlook

We project the industry will break through to $60.0 billion in 2017 and $70.0 billion in 2019.

China will lead the growth with a CAGR of 7.9%, followed by Asia 4.8% and North America 4.6%. Europe and Japan will grow, but slightly less than North America.

Bishop & Associates new World Connector Industry forecast is now available. For more details click here.

Ronald E. Bishop

Ronald E. Bishop founded Bishop & Associates Inc., a market research firm that specializes in the world electronic connector industry, in 1985. The firm publishes a monthly newsletter titled “The Bishop Report,” and the twice-monthly digital publication Connector Supplier.

The reports, produced by a staff of 20 researchers, focus on geographic regions, end-user equipment markets, connector products, and interconnect technologies.

The firm also provides executive placement services and conducts multi-client studies and customer surveys, and assists in merger and acquisition activity.