General Outlook: Toward more Professional Electronics, a Chance for North America and Europe

02/18/2014 //

Ten years ago, North America, Europe and Japan recovered from the telecom crisis but still represented, as a group, around two-thirds of global electronic equipment production. In 2012, the historically developed economies represented only slightly more than 40% of this world production. This share has constantly declined ever since as the specialization of these countries on professional production segments has not compensated for the decline of mass-market device production in the same group of countries.

Valued at more than 1,410 billion euro in 2012, the fortunes of the electronics industry are completely intertwined with the global economy as it should grow on average at 3.2% per year until 2017 to reach 1,655 billion euro.

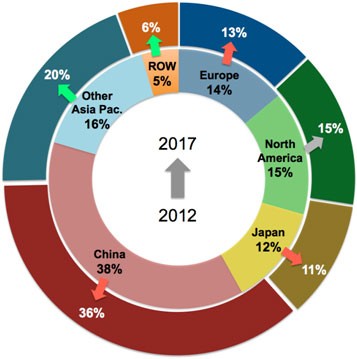

World electronic equipment production by region in 2012 (center) and 2017 (on the edge)

Source: DECISION, World Electronic Industries: 2012 – 2017 (Feb. 2014)

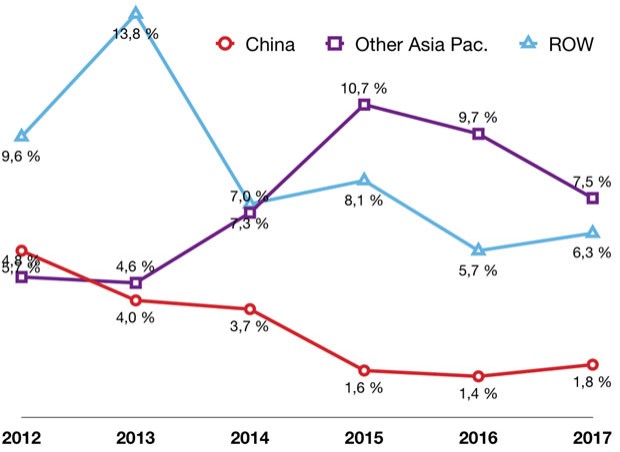

Of course, China benefited most from this production transfer and its share of world production more than doubled in the last decade to reach 38% in 2012. However, its development is now evolving to focus more than ever on internal demand, diversification to professional electronic segments and international investment. In addition, due to rising labor costs, China is seriously challenged by other economies in the other Asia-Pacific region, which includes emerging countries like India, Vietnam or Malaysia, capable of churning out some of the same consumer electronic goods at a cheaper cost. As a consequence, while China should remain the largest electronic equipment manufacturing country in value, its production share is expected to decrease over the 2012 – 2017 time frame to reach 36% at the end of the forecast period.

Less impacted by the financial crisis compared to developed countries, emerging countries are still targets for foreign direct investment due to good market perspectives and their situation of relative cheap production areas.

In 2012, the other Asia-Pacific region accounted for 16% of the world electronic equipment production. Over the forecast period, we estimate the region to experience the highest regional average annual growth rate with 7.9% and to consolidate its rank of second largest electronic manufacturing area with 20% of the world electronic production share. This strong growth can be explained by the trend to delocalize electronic plants from China to adjacent countries to lower production costs especially for low-end, mass-market products (like basic mobile phones, etc.) in a first step.

Similarly, the electronic production in the Rest of the World (South America, Africa, etc.) is forecast to be also very dynamic with an average growth rate to stand at 7.2 % through 2017 driven by a strong demand in telecommunication equipment and industrial plus aerospace and defense electronics. With the willingness of emerging countries to develop their electronics industry, industry players are politically incented to establish production sites to reinforce their presence in these markets. A trend strengthening the dictum that production follows markets.

Electronic equipment production growth rates per year in China, Other Asia-Pacific and ROW

Source: DECISION, World Electronic Industries: 2012 – 2017 (Feb 2014)

In this context, Europe, North America and Japan are facing a much more sluggish situation as none of these regions will see its share of electronics production rise during the forecast scenario.

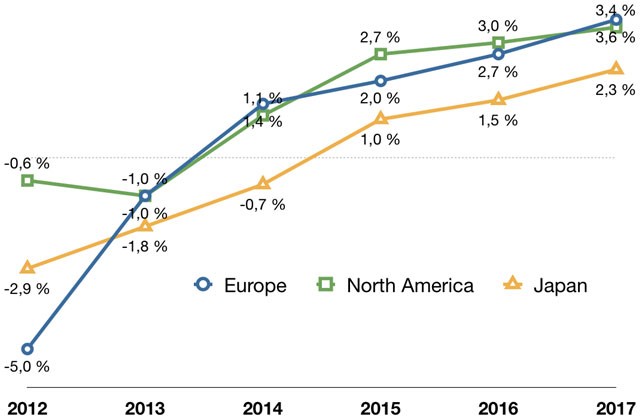

Electronic equipment production growth rates per year in Europe, North America and Japan

Source: DECISION, World Electronic Industries: 2012 – 2017 (Feb 2014)

Indeed, all will continue to suffer from the harsh competition of emerging countries that produce mass-market electronic goods. Some of the historical electronic leaders are in a difficult position. After 15 years of domination, the former European mobile phone leader, Nokia, passed up the chance to impose its view during the smartphone revolution and now its production strategy is to be outside of Europe. For different reasons, Blackberry is in an equivalent situation. The collapse of the production of telecommunication equipment in Europe and North America is one of the reasons that explain their global weak performance in electronic production.

Even more consumer-oriented, Japanese manufacturers have to cope with the pressure of their Asian neighbors especially in the Audio-Video segment, since Japan continues to produce on its territory: televisions, game consoles, etc, market segments where Sony, Panasonic, etc. experience increasing competition from South Korea and even new comers from China. With both an ageing population and industrial base requiring huge investment to maintain its competitiveness, Japan should continue to outsource more and more of its consumer electronic output.

However, with respectively 1.7% for Europe and 1.9% for North America of CAGR over the period 2012 – 2017, the production of electronic equipment dedicated to automotive, aeronautics and industry/medical largely compensated difficulties in the ICT segment. Indeed and in spite of public budgetary constraints hampering some market segments like defense or medical equipment, Europe and North America managed to strengthen their leads by benefitting from the high demand worldwide for those professional products with sharply increasing electronic content.

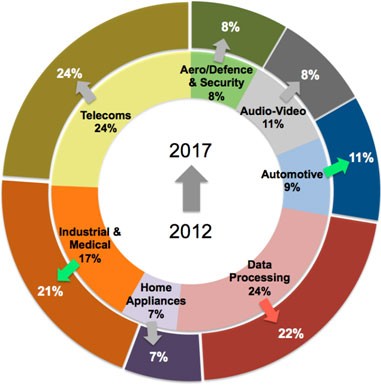

World electronic equipment production in 2012 (center) and 2017 (on the edge)

Source: DECISION, World Electronic Industries: 2012 – 2017 (Feb 2014)

Traditional 3C markets (Consumer, Communication, Computing), better known under the ICT acronym, still represent the largest market/production share for electronic equipment worldwide with 66% of the global electronic output. These end-application sectors remain essentially driven on the one hand by mass-market demand and corresponding devices such as smartphones, PCs, tablets, or televisions produced by hundreds of million or even billions of units every year and on the other hand by the related infrastructure equipment necessary to cope with increased data traffic over the internet.

These markets are now fully engaged in the digital convergence era with profound consequences on suppliers’ strategies and organizations. The most striking example of this trend is that PC production is cannibalized by mobile devices like digital tablets and smartphones as in 2012 PC production (desktops and laptops) whose value is already overtaken by the combined production figures of smartphones and tablets.

By the end of 2012, tablets had only 2.5 years of existence and just six years for smartphones. And in this same year, the sole revenues created by the iPhone sales generated more profit than Coca-Cola or Boeing.

On the other hand, professional electronic production in value, comprising electronic equipment embedded into aircraft, defense and security systems, automotive, trains, ships, medical equipment, … but also into a myriad of equipment for all the industry like automation, power supply, etc. is expected to increase significantly from 486 billion Euro in 2012 to 656 billion in 2017 ($655 to $885 billion) or 40% of worldwide electronic production compared to 34% five years earlier.

Electronic equipment production growth rates per end-sectors

Source: DECISION, World Electronic Industries: 2012 – 2017 (feb 2014)

Indeed, yearly average growth of all the professional sub-segments should outperform world global electronic production trend set at 3.2%.

- With 4.3% of CAGR until 2017, the electronics dedicated to the aerospace/defense and security sectors is driven by several factors:

- The societal need for security is deeply related to the globalization process and the vulnerability of developed economies to both external and internal threats. The security market covers in fact a wide spectrum of concepts from the security of citizens and countries (homeland security) to the trust in digital technologies (IT-security), making security a heterogeneous market both from a demand and a supply side perspective (air and sea port protection, biometric IDs, chemical detection, etc.).

- While defense budgets are squeezed in mature economies, they continue to rise in developing countries.

- Last but not least, the civil aeronautics market is booming, driven by high demand in air travel especially in emerging countries. In addition, the value of electronic equipment used by modern aircraft will increase dramatically with the arrival of the generation of “all electric aircraft” like the B787 or the A350. DECISION estimates that the share of on-board electronic equipment will nearly double from 6% for old generation aircraft to 11% for new wide bodies and future aircraft projects. This will naturally boost electronics production for the aeronautics market.

- With 7% of CAGR until 2017, the electronics dedicated to the automotive business sector is driven by two main factors:

- Structurally, global demand for automotive will continue to grow thanks to high demand from emerging countries whose automobile penetration rates are still at a low level.

- As in aircraft, the amount of electronics per car will soar thanks to new embedded technologies. The three main electronic innovations that will drive automotive electronics growth are:

- Increased energy efficiency with the electrification of drivetrains, the replacement of mechanics by smart electronics, smart grid connection, etc.

- More devices enabling communication between cars, people and infrastructure

- More advanced safety equipment like traffic management systems, driver assistance technologies, etc.

- Production of electronic equipment for the industry increases at a fast pace: Including many differentiated segments, the electric and electro-mechanic industry is also benefiting from progress in terms of performance and productivity provided by electronic technology. To answer the universal challenges of energy consumption management, healthcare expense control of ageing populations, or demands for increased mobility, all industrial segments are reinventing their products and solutions.

- Globally linked on dedicated investments, the world industrial and medical electronics production will start a new growth cycle which is forecasted to reach 6.5% per year on average over the period 2012 ─ 2017.

Didier Coulon

Didier Coulon is Founder and CEO of DECISION, an independent consulting firm offering expertise to its customers in the field of electronics, components, aerospace and defense, energy and electrical engineering. Coulon worked as a strategy consultant in various consulting firms for several years and also worked as the director of the information technology division at BIPE, a major French consultancy company.