Whatever the Future of the Automotive Industry, Electronics is the Key

09/09/2014 //

Today, electronics represent around 25% to 30% of a modern car production costs but, more importantly, electronic systems now contribute 90% of car innovations and new features, from emission levels to safety systems (both active and passive) and entertainment/connectivity features. There is not one new development in the automotive industry that does not rely on electronic systems and technologies.

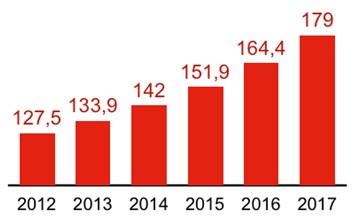

Between 2012 and 2017, the automotive electronics production is expected to grow at a strong average annual rate of 7.0% worldwide, to reach 179 billion euros by the end of the period.

Worldwide production of electronic equipment dedicated to automotive (in billion euros)

Source: DECISION

Compared to the 4.0% average growth expected for the car market, this higher growth rate can be explained by the following factors:

- The car industry is entering a new age of electronics with new safety and connectivity system solutions which is going to give a new boost to "pervasion" (i.e. increasing penetration rate of electronics in the car).

- There is a relentless and strong demand from the public authorities for improving energy saving, pollution control and road safety which can be satisfied only by electronic solutions.

- The crisis and the environmental awareness have caused a demand shift from high-end cars and large platforms to more affordable mid-range and smaller vehicles, including some "low cost" cars with less electronic content in Western Europe. Nevertheless, the new vehicle generations in general have a rapidly growing electronic content, as the most recent security and comfort equipment is becoming standard in the mid-range and lower end vehicles.

- Most of the growth in global car sales will come from emerging regions where the electronic content per vehicle is currently smaller than in developed countries; this will provide room for future growth.

- The development of hybrid and electric vehicles with a higher electronic content will have an increasing (although relatively limited) impact on the global automotive electronics market during the forecast period; the impact of this development will continue to increase between 2017 and 2020 and should become prevalent beyond 2020.

- The end of the forecast period will see the beginning of the boom of connected cars with a proliferation of dedicated on-board systems, as well as public and private specific communication infrastructure.

We already live in a networked society dominated by connectivity and mobility and we are currently entering the era of the digital car. The connected car is expected to provide the ultimate solutions to road safety and intelligent transport, while enhancing passengers' information and entertainment capabilities. Communication networks will be used to implement a large array of services for the car drivers and passengers as well as for developing a totally new concept of smart traffic management.

The connected car is already on the road. According to industry experts, it represented 11% of car sales in 2013 and it could reach 80% in 2018, when 20% of all the automobiles in circulation will be connected cars. The market is pulled by the high-end segment, which should register 66% of connected cars sold in 2015, against 52% for the mid-range and 26% for the low-end. According to a study from SBD and GSMA, the market of dedicated hardware and services for connected cars could reach 40 billion euros in 2018.

The connected car will address a high variety of needs, customer, industry and society-centric. The first services, which are already being implemented or will be in the near future are related to entertainment (music and video streaming), driving assistance (road maps and guides, traffic information, parking location research) and integrated vehicle information (on-board and remote diagnostics, predictive maintenance). By the end of the decade, the connected car will go one step further into smart communication solutions with car-to-infrastructure and car-to-car communication as part of traffic management and crash avoidance.

There are considerable technological and legal challenges to be addressed to allow a correct implementation of these smart advanced solutions. Data management is one of the most crucial issues, with software downloading and updates, as well as private data circulation. Network access will require SIM management and fraud protection. In order to be able to manage the huge amount of data that will be generated by the new services, the mobile networks will have to offer a lot of additional bandwidth, which will be compatible with only 5G for large-scale deployment. It will be necessary to ensure full interoperability and nowadays the fragmentation of mobile protocols is a real issue. Car-to-car communication through the cloud is complex and expensive; there is also a need for specific legislation and standardisation at application level.

The prospect for more connected infotainment is strongly attracting the leading digital service and OS suppliers. The struggle for the control of car infotainment command has accelerated with the announcement by Apple of partnerships with several carmakers like Audi, Chevrolet or Hyundai to introduce into the native in-car control system interface a direct link with Apple’s smartphone OS called « iOS in the car ». In March 2014, Apple officially launched its solution renamed "CarPlay". This embarked software allows the driver to take the control of his/her iPhone and utilize various functions such as messaging, music download and satellite navigation, in addition to the basic telephone services. Once connected, the iPhone OS is transferred onto the multimedia screen of the car and is controlled either by a dedicated button on the steering wheel or by voice through Siri, Apple's voice recognition software, which will increase the global level of security for the driver. Of course Apple will not be alone as Google also unveiled a partnership with Audi which was broadened in January 2014 to three other major carmakers (GM, Honda and Hyundai) together with the U.S. chipmaker Nvidia.

The new battle between Apple and Android has just started and Microsoft is lagging, like in smartphones and tablets. Clearly business models bringing more connectivity into cars is attracting new players into the century-old automotive industry value chain.

Car manufacturers have proved unable to design appealing and efficient in-car control interfaces, so the promising future of the connected car is opening an opportunity for new entrants, the software specialists from the IT industry like Apple, Google or Microsoft, to step into the automotive market.

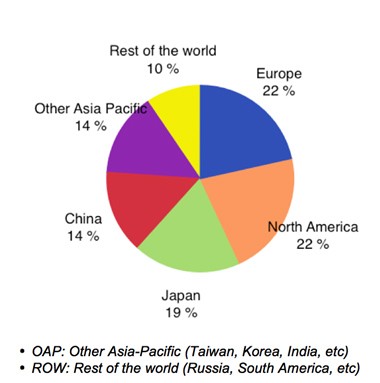

Automotive electronics production breakdown forecast by region in 2017

Source: DECISION

Didier Coulon

Didier Coulon is Founder and CEO of DECISION, an independent consulting firm offering expertise to its customers in the field of electronics, components, aerospace and defense, energy and electrical engineering. Coulon worked as a strategy consultant in various consulting firms for several years and also worked as the director of the information technology division at BIPE, a major French consultancy company.