Weekly Global Update for July 24, 2013

07/24/2013 //

Japanese Electronics Update

May 2013 domestic Japanese electronic equipment, component and device shipments were just published on the JEITA website:

- Electronic equipment shipments were down 19% in May 2013 vs. May 2012 but improved slightly from April to May of this year (Charts 1 & 2).

- Printed circuit board shipments rose slightly from April to May 2013 but were down 19% compared

to May 2012 (Chart 3). - 3/12 growth of PCBs improved but was still well below the "real growth" point where 3/12=1.0 (Chart 4).

- Japan’s PMI leading indicator points to continued improvement in PCB growth (Chart 5).

- Device growth is now positive while component growth is improving on a 3/12 basis (Chart 6).

- Semiconductor shipments to Japan are exceeding electronic equipment growth on a 3/12 basis suggesting either/or over-ordering or inventory building of semiconductors in Japan (Chart 7).

Source: www.jeita.or.jp/

Apple has stepped up IC orders

Apple has stepped up its pace of chip orders indicating the vendor is gearing up to launch new products.

IC orders placed by Apple for the third quarter have nearly doubled over the prior quarter, according to sources at its supply chain partners. Thanks to the upcoming rollouts of new iPhone and iPad devices, overall chip shipments to Apple are set to grow significantly in the second half of 2013, said the sources.

Overall IC shipments for iOS devices in the second half of 2013 are expected to account for as high as 70% of the total for the year, the sources indicated.

Apple started to reduce its chip orders in the fourth quarter of 2012, and maintained the slow pace of orders until second-quarter 2013, the sources said. Shipments for iPhone components from the IC supply chain, for example, fell to about 20 million units quarterly during the period, the sources noted.

However, with a new model set to launch, IC shipments for iPhones will ramp up to 40 million units in the third quarter, the sources predicted.

Source: www.digitimes.com

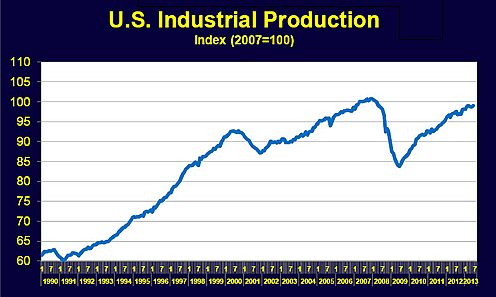

U.S. Industrial Output Rises Most in Four Months

Preview, Chart 8

Source: www.federalreserve.gov/releases/g17/table1_2.htm

Global Industrial Production Growth by Country

Chart 9 shows industrial production growth by country for a recent month vs. that same month a year earlier. Most of Europe and a number of the key Asian countries reported a recent decline in industrial production.

Source: www.economist.com

North America Semiconductor Equipment July Book/Bill 1.10 (Charts 10 & 11)

North America-based manufacturers of semiconductor equipment posted $1.33 billion in orders worldwide in June 2013 (three-month average basis) and a book-to-bill ratio of 1.10, according to the June EMDS Book-to-Bill Report published today by SEMI.

The three-month average of worldwide bookings in June 2013 was $1.33 billion. The bookings figure is 0.7 percent higher than the final May 2013 level of $1.32 billion, and is 6.6 percent lower than the June 2012 order level of $1.42 billion.

The three-month average of worldwide billings in June 2013 was $1.21 billion. The billings figure is 1.4 percent lower than the final May 2013 level of $1.22 billion, and is 21.4 percent lower than the June 2012 billings level of $1.54 billion.

"The SEMI book-to-bill ratio has been above parity for six consecutive months and bookings in the quarter ending in June are 20 percent above the quarter ending in March," said Denny McGuirk, president and CEO of SEMI. "As recently announced, we anticipate that total worldwide equipment spending will decline by low single-digits this year and rebound with a double-digit growth rate in 2014."

Source: www.semi.org

Notebook ODMs Reduced Shipment Forecasts for 3Q’13, Expect Growth in 4Q’13

Notebook ODMs recently have reduced their shipment forecasts for the third quarter of 2013 and expect to achieve a shipment growth of only 5% sequentially. The ODMs now expect consumer demand to start appearing in the fourth quarter.

Notebook ODMs pointed out that their brand vendor clients have been decreasing orders for the third quarter recently, forcing them to drop their shipment estimates sharply by over 10pp from their original forecasts.

Wistron chairman Simon Lin pointed out that the second half will benefit from seasonality, but growth will be limited and mainly occur in the fourth quarter. Lin also believes that notebook shipments in the second half are unlikely to see any major growth over the first.

Quanta Computer is the most optimistic player about second-half performance and expects its shipment ratio for the first and second halves of 2013 to reach 4:6.

Since many new products and applications such as Windows 8.1 are set to be released in the fourth quarter, Lin believes new devices should help attract consumer demand.

Source: www.digitimes.com

Global notebook shipments are expected to suffer an on-year decline of 10.8% in 2013; shipment decline to ease in 2H’13 (Chart 12)

Although global notebook shipments in the second half of 2013 will not see a double-digit percentage on-year drop like in the first, they will still suffer a 6-7% decrease during the period, and in terms of a quarterly comparison, global notebook shipments will only see 4.8% growth in the third quarter, showing that supply side promotions only had a limited effect in boosting demand, according to Digitimes Research's latest figures.

Global notebook shipments are expected to suffer an on-year decline of 10.8% in 2013, higher than previously estimated, while Taiwan's shipment drop will reach 15.5% on year mainly because Lenovo has been increasing its in-house notebook production, and the percentage is estimated to reach 30% by the fourth quarter, Digitimes Research figures showed.

Among the top-10 brand vendors, Apple, Lenovo and Hewlett-Packard (HP) will enjoy better shipment growths in the second half compared to the first. Apple will mainly benefit from its new MacBook Pro products ready for launch in October, while Lenovo will see increasing contributions from markets outside of China, and HP will benefit by a recovery of enterprise market demand.

Since Apple and HP's notebook orders will turn strong in the second half, their major ODM partner Quanta Computer is expected to benefit the most, while Inventec, the main ODM for HP's enterprise notebooks, will also enjoy some shipment growth.

Source: www.digitimes.com

Notebook ODMs Demanding Their Suppliers Cut Quotes Directly to Levels Asked Instead of Dropping in Stages

Relationships between notebook ODMs and component suppliers have turned tense recently because ODMs have started demanding their suppliers cut quotes directly to the levels asked instead of dropping in stages, according to sources from the upstream supply chain.

Most upstream suppliers have coordinated with the ODMs' demands, but some are delaying shipments to fight back the strategy.

Because of China's increasing wages and exchange rates, most upstream suppliers are already suffering from declining gross margins, and as notebook shipments are dropping, the sources are concerned that the ODMs' demands could impact their performances in 2013.

Quanta Computer shipped 20 million notebooks in the first half, and since the company is unlikely to achieve strong growth in the second half, the company's annual shipments in 2013 are expected to be a lot lower than its 2012 shipments at 53.8 million units. However, Compal Electronics is expected to enjoy a slight growth from shipments of 39.4 million units in 2012 to 39.9 million in 2013.

Wistron's shipments in 2013 are expected to see a slight drop from 2012's 31.5 million units.

Source: www.digitimes.com

Metal Prices

Recent metal prices:

- Copper (Chart 13)

- Tin (Chart 14)

- Silver (Chart 15)

- Gold (Chart 16)

Sources as noted on charts

Walt D. Custer

Walt Custer is an industry analyst focused on the global electronics industry. Prior to forming Custer Consulting Group he was Vice President of Marketing and Sales for Morton Electronic Materials, a global supplier of specialty chemicals and process equipment for the PCB industry.

Custer has been a member of the IPC trade organization since 1975 where he received both the President's and the Raymond E. Pritchard Hall of Fame Awards. He is currently a member of the IPC Executive Market & Technology Steering Committee. Custer is also a Director of the EIPC European PCB trade organization.

He authors regular “Market Outlook” columns for Global SMT & Packaging magazine, the Journal of the HKPCA and the TTI MarketEYE website.