Methodologies For Achieving Financial Stability In Adverse Market Conditions: FY 2014

05/22/2013 //

The Downward Gross Operating Profit for Passive Component Manufacturers:

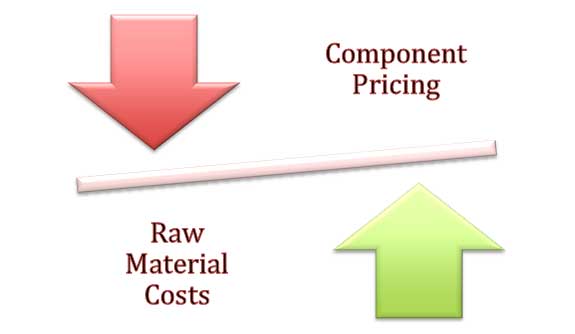

Between 2007 and 2013 the collective gross profit margins of the world’s top passive component manufacturers has declined by 26%. This notable change in the gross operating profit means that these top vendors of capacitors, resistors and inductors are experiencing higher variable costs (raw material costs) at the bottom end of the supply chain and aggressive price competition at the customer end of the supply chain, which is squeezing the profitability out of the industry.

The reader should also understand that the unique nature of the passive component supply chain is largely to blame for its unusual predicament of higher raw material costs and lower pricing. Passive components, capacitors, resistors and inductors differ somewhat from other electronic components, such as semiconductors, because of their reliance on engineered raw materials, which represent a significant portion of their variable cost structure. What's more is that many of the raw materials consumed in passive components are considered rare earth, precious metals and conflict minerals, and are therefore in an increasing state of diminishing and disruptive supply, which has the tendency to create explosive fluctuations in price.

The Trend in Research and Development Spending:

And while gross operating profits for passive component manufacturers are declining due to increased raw material costs and lower component pricing, spending on research and development as a percentage of overall revenues is increasing. Engineers who design in passive components continue to task their vendors to create products with enhanced performance at increasingly lower prices. Between 2007 and 2013 research and development costs for the world’s top 13 vendors of passive components has increased by 10% as a percentage of total revenues and 46% in real dollars. Companies involved in extending high capacitance MLCC have experienced the largest increases in research and development spending followed by manufacturers involved in enhancing conductive polymer cathode performance.

The Trend in SG&A Spending:

Selling, General and Administrative Expenses (SGA) generally can be described as how much a company spends trying to convince the customer to buy. More importantly, it can be viewed as spending on overall “brand” development. The intense competitive nature of the passive component industry continues to spur vendors to spend more to get design engineers to recommend their products for the approved vendors list on multiple circuits. Between 2007 and 2013 the top vendors of passive components have increased the amount they spend on SGA by 2% as a percentage of total revenues and 36% in real dollars.

The Trend in Average Stock Price:

An analysis of the average stock price for the top global passive component manufacturers has declined by 16% between 2007 and 2013. Of the top 12 companies that are traded, only three grew in value between 2007 and 2013- while the rest of the top publically traded companies showed declines in stock value during this time period, reflecting negative valuations amidst shrinking margins.

Vendor Attempts at Remaining Competitive:

Amidst a climate that is marked by significant downward price pressure and growing costs to produce; higher research and development costs; higher SGA expenses; and dwindling stock prices, vendors have been pulling out all the stops in attempting to create a financially solvent environment.

- Broadening The Product Portfolio:

- Historically, a focus on one type of passive component was the strategy that lead to the highest gross profits for manufacturers, with emphasis on ceramic capacitors, and high capacitance MLCC at that. However, over time this strategy has given way to one that offers the customer a broad supply of multiple dielectrics, resistive elements and inductors. Since 2007 the broad product portfolio strategy has emerged as the most lucrative for vendors of passive components to be a one stop shop for the customer is the method of components supply with the greatest leverage to produce profitability above the industry norm.

- Broadening the Customer Base:

- Another method for achieving gross profit margins above the industry norm is to develop and supply value-added and application specific passive electronic components that have higher average unit prices and higher gross profit margins than passive components consumed in mass commercial markets. Mass commercial markets traditionally include wireless handsets, computers and TV sets and related consumer audio and video imaging equipment. Value-added and application specific passive components include end-markets in telecommunications infrastructure, automotive, aerospace and defense, medical, oil and gas, instrumentation and renewable energy systems.

- Broadening the Regional Sales Base:

- Companies with the highest operating margins in passive components certainly have the majority of their revenues in the Asia-Pacific region, with emphasis upon China, Korea, Singapore, Philippines, Thailand, and Malaysia, but this only guarantees volume of sales and not necessarily profitable business. Vendors with the highest operating margins have respectable market positioning in all key regions; and have at least a 10% share of the U.S., German and Japanese home markets.

- Diversifying the Regional Production Base:

- Paumanok estimates that about 85% of the world’s passive components are manufactured in Asia, and that China and Japan account for about 65% of the total combined output of passive components. Other key production bases in Asia include Singapore, Korea, Malaysia, Indonesia and the Philippines. Outside of Asia, the key locations of passive component production include the United States, Germany, Mexico, Israel, Czech Republic, Italy, Holland, Belgium, Spain, Portugal and Brazil.

- The current trend is to move as much production away from yen, euro and dollar based manufacturing to some other currency. It is arguable that production in regions that support the U.S. dollar already have moved to a value-added and application specific market environment, and the production in Germany has also done the same.

- The area where we expect the greatest future movement is in Japan, where more than 30% of the world’s passive electronic components are still manufactured, and where a trend is underway to move production to non-yen based areas of production, most notably to regions where other passive component manufacturers have already set up shop so that vendors can take advantage of an infrastructure and workforce that is already familiar with the unique nature of building and shipping passive components.

- Many vendors support the theory that production in China makes the greatest economic sense because of the low valuation of the renminbi and the proximity to the end-customer, which ultimately saves on freight charges. Certainly this theory has supported China as the fastest growing region for passive component production over the past ten years. However, other passive component manufacturers are equally intrigued by production in Korea, where the low valuation of the won and high degree of loyal work ethic among the populous are equally compelling.

Future Outlook for the Vendors of Passive Components:

The trend of higher costs to produce passive components is expected to continue over time. Once the global economy begins to thrive again, we expect that various industries will compete for raw materials that are required for the production of passive components. Materials that are expected to experience shortages will include, but not be limited to tantalum, neodymium, palladium, and titanium; while additional strains will be put on aluminum (bauxite), nickel, copper, zinc, barium, ruthenium and various plastics. Competition for these materials will drive up the costs to produce passive components.

Costs associated with research and development and SG&A expenses are also expected to continue to rise for producers of passive components, further squeezing gross margins.

More M&A:

The only logical solution over time will be consolidation of passive component manufacturers into a few major vendors who have greater leverage to raise component prices when faced with rising costs.

We expect increased merger and acquisition activity in the global passive components space among vendors whose combination offers savings based on combining the SG&A and research and development costs of the merged companies. Also mergers will be more likely if it creates new market opportunities for vendors based on region (i.e. Western access to the Japanese market for example), new production bases (preferably in Asia), and a broadening of the product portfolio (into additional dielectrics, resistive elements or inductive products) or acquisitions that expand the customer base into value-added and application specific customer bases where profitability is greatest.

Dennis M. Zogbi

Dennis M. Zogbi is the author of more than 260 market research reports on the worldwide electronic components industry. Specializing in capacitors, resistors, inductors and circuit protection component markets, technologies and opportunities; electronic materials including tantalum, ceramics, aluminum, plastics; palladium, ruthenium, nickel, copper, barium, titanium, activated carbon, and conductive polymers. Zogbi produces off-the-shelf market research reports through his wholly owned company, Paumanok Publications, Inc, as well as single client consulting, on-site presentations, due diligence for mergers and acquisitions, and he is the majority owner of Passive Component Industry Magazine LLC.