High Capacitance MLCC: Competition at the Granular Level

07/17/2013 //

Introduction: Competition in High Capacitance MLCC Is Intense

As the global multilayered ceramic chip capacitor (MLCC) markets approach the $10 billion U.S. dollar mark, competition is increasingly becoming more diversified as vendors rush to create new ceramic capacitor products that extend the traditional boundaries of the finished component into new areas to create new and exciting products. These products primarily increase volumetric efficiency while increasing capacitance, which are two end results that are technically opposed to each other. The value-added comes into the equation when additional aspects of the high capacitance MLCC are also tweaked along with increased volumetric efficiency and increased capacitance, such as higher operating voltages, performance characteristics and lower profiles. The competition among the top manufacturers of MLCC Murata, TDK, Samsung, Taiyo Yuden, Yageo and Walsin to create a differentiated product line is understandably as aggressive as it is intense because the first to market with a differentiated high capacitance MLCC product can enjoy up to a six to 24 month premium in price and profitability before the competition catches up and begins the tedious process of global price erosion.

High Capacitance MLCC: Market Dominance over Alternative Technologies:

The global MLCC market has outperformed the other primary capacitor dielectrics (i.e. tantalum, aluminum and plastic film capacitors) in terms of revenue generation over the past decade because of dramatic breakthroughs in electrostatic capacitor technology. These breakthroughs involve an increase in the capacitance value per cubic centimeter of ceramic capacitor, which in turn allows ceramic capacitors to effectively compete against electrolytic (i.e. tantalum and aluminum) capacitor technologies respectively. Since the pricing of capacitors is primarily dependent upon the combination of capacitance value, voltage rating and performance characteristic, the high capacitance MLCC can generate higher average unit pricing per piece as it moves up the electrolytic scale of value. This process also enables ceramic capacitors to generate the highest percentage of profitability of all the capacitor dielectrics, which in turn enables the top manufacturers to spend a higher percentage of their revenues on research and development, which invariably improves and entices the development process.

The MLCC generates capacitance through the stacking method, while other types of capacitors employ the wound method (aluminum and plastic film types), and still others employ the porous anode method (tantalum). Each of these methods conforms to the scientific maxim that capacitance is equivalent to the physical size of the finished product, or in fact, the available surface area of the finished product. In the MLCC, the surface area is increased by stacking up multiple layers of ceramic dielectric materials and metal electrode materials; while the wound solution increases the available surface area by tightly winding up a coated plastic film or aluminum metal foil, or by creating a surface area on a porous substrate. While the other dielectrics have been successful at increasing their capacitance value per cubic centimeter of capacitor, MLCC have dominated the process because they do so cost effectively. Ultimately, the feedstock materials associated with the production of ceramic chip capacitors is lower than the feedstock materials associated with other dielectrics. This gives MLCC a competitive advantage in the continuing quest for higher capacitance.

High Capacitance MLCC: to be First to Market with Differentiated Products:

The MLCC has in fact lent itself to significant advancements in the creation of capacitance because the materials that create the capacitor are readily manipulated through nanotechnology; or the consistent generation of spherical ceramic and metal particles that in turn create consistent and uniform dielectric and electrode layers at increasingly thinner levels. This, in turn, enables the capacitor manufacturer to stack up increasingly larger numbers of matching layers of dielectric and electrode within the standard capacitor case sizes, i.e. EIA 0201, 0402, 0603, 0805 and 1206, and subsequently increase the available surface area, and the corresponding capacitance of the finished capacitor. Therefore, from a market perspective, MLCCs have encroached upon alternative dielectrics, and augmented their existing $4 billion picofarad market with a $6 billion microfarad market (for MLCC between 1 and 100 µF); a market which would have otherwise gone almost entirely to tantalum chip capacitors.

So in addition to competing against manufacturers of electrolytic capacitors, MLCC vendors are also highly in tune with each other, and compete aggressively for share in the granular nooks and crannies of the high capacitance MLCC markets worldwide. To be first to market with differentiated MLCC products can mean enhanced profitability for the vendor for as long as 24 months, or until the competition figures out how to emulate such success at high yields. These areas of competition are primarily focused upon increasing the maximum capacitance value of high capacitance MLCC in general; increasing maximum capacitance value for each of the MLCC chip case sizes, increasing capacitance value while also increasing chip operating voltage, increasing capacitance value while not impeding chip performance characteristic, and increasing capacitance value while decreasing chip thickness.

Examples of each of these granular trends and the roadmap for future development is as follows:

- Increasing the Maximum Overall MLCC Capacitance Value:

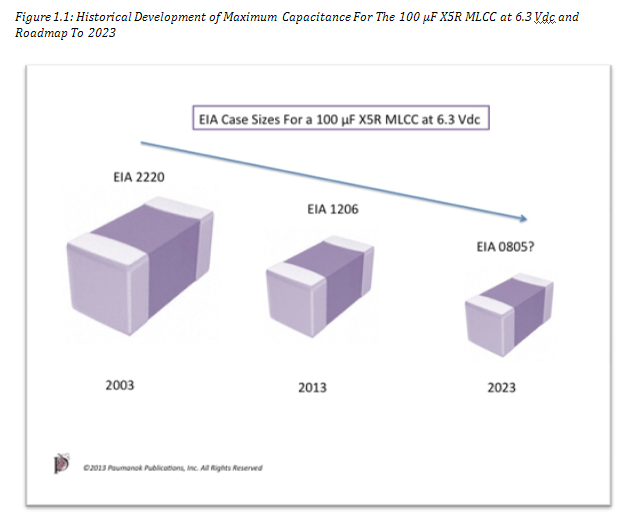

As we have noted, the “name of the game” in high cap MLCC (by definition) is increasing capacitance value within each individual MLCC case size. According to Paumanok research, the 100-microfarad MLCC has been commercially available for more than a decade, and had been the highest capacitance MLCC available until the recent introduction of the 220-microfarad MLCC (1210 case size at 6.3 volts from Samsung and Murata). However, a decade ago, the 100-microfarad X5R MLCC was available only in 6.3 volts and in the relatively massive EIA 2220 case chip size only.

However, today, the same 6.3 volt 100 microfarad X5R MLCC is now available in the much smaller 1206 case size. And this is a testament to the successful application of nanotechnology to multilayered ceramic chip capacitors, spurred on by intense competition among vendors. One interesting side note is that it took a decade for the ceramic capacitor manufacturers to break down the 100-microfarad barrier and produce a 220-microfarad ceramic chip capacitor. This is an important milestone because it extends the total available market for high capacitance MLCC further into the tantalum chip and solid polymer aluminum chip capacitor segment and enables the early vendors who developed this product line to generate a price premium until the market becomes saturated with additional vendors. The technology roadmap for high capacitance MLCC suggests that by the year 2023 that the 100 µF X5R at 6.3 Vdc will be available in the 0603 case size (See Figure 1.1).

- Increasing the Maximum Capacitance Value for Each of the MLCC Chip Case Sizes

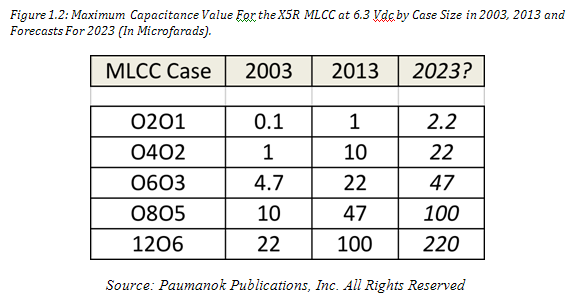

As we have noted, Paumanok research suggests that the high capacitance MLCC market begins at 1 microfarad. In 2013 the 1-microfarad chip capacitor in X5R is available in the ultra-small 0201 case size. The future area of competition among vendors will be to create a 1-microfarad MLCC in the even smaller 01005 case-size, and to expand the 0201 case size to 2.2 microfarad. The ultra-small case size MLCC pose a difficult area to expand capacitance, because of the limitation of length and width; therefore, the only way to increase capacitance is to increase the number of layers within the ultra-small chip by reducing the particle size of the dielectric and electrode, and to be able to manufacture the capacitor with a high yield ratio so as not to impede profitability. Ten years ago, for example, the 1 microfarad MLCC was available in the 0402 MLCC case size (one case size larger than the current 0201) and at the opposite spectrum, a decade ago the 22 microfarad MLCC was available in the 1206 case size, while today it is available in the 0603 case size (two case sizes smaller). The future direction at the higher end of the MLCC spectrum will be the (theoretical) creation of a 0805 case size MLCC at 100 microfarad and the 1206 case size at 220 microfarad (See Figure 1.2).

- Increasing MLCC Capacitance Value While also Increasing Chip Operating Voltage

Higher-capacitance MLCC have low operating voltages, because the final operating voltage of the MLCC is ultimately determined by the thickness of the dielectric layer. The dielectric thickness in an MLCC also determines how many layers you can have, which in turns supports the overall capacitance of the MLCC. Therefore, capacitance and voltage are ultimately working against each other in the final product. Generally speaking, we usually see the highest capacitance MLCC, regardless of case size, in the 4.0 Vdc or 6.3 Vdc operating voltages. However, the real challenge is increasing that voltage to a useable 10 volt, 16 volt or 25 volt part without seriously impeding the overall capacitance value of the chip, and accessing the end-product markets that require components that operate at such voltages. It could be argued that in 2013, the maximum high capacitance chip voltage is 16 Vdc with the 25 Vdc parts currently being commercialized at the 1.0 microfarad threshold in the 0805 case size; and at 50 Vdc in the 1206 case size (and at higher voltages in the larger case sizes). Therefore, the future challenge will be to increase voltage and capacitance at the same time, even though the two characteristics oppose each other (an incredible challenge).

- Increasing MLCC Capacitance Value While not Impeding Chip Performance Characteristics:

Most of the higher capacitance MLCC sold on the market today are manufactured in either the X5R or Y5V performance characteristic. High capacitance MLCC are also available in the more stable X7R characteristic, but their maximum capacitance values are limited. Also, high capacitance MLCC in the NPO (COG) type and the X8R type are extremely limited. The variable characteristic in all these types of capacitors is the maximum temperature range, with the X5R MLCC available to a maximum of 85 degrees C in operation and the X7R available to a maximum of 125 degrees C in operation. The larger percentage of market demand is for high capacitance MLCC greater than 1 microfarad with either X5R or X7R performance characteristics, so this is where research and development is concentrated. For example, a decade ago, the maximum capacitance value of the 0805 X7R type MLCC was 2.2 microfarad, and today it is 4.7 microfarads. In the X5R MLCC for example a decade ago the maximum capacitance value of the 1206 case size MLCC was 22 microfarad, and today it is 47 microfarad. The future direction for example, would be to elevate the 0805 X7R type MLCC to 10 microfarad and to elevate the 1206 case size X5R MLCC to 100 microfarads.

- Increasing MLCC Capacitance Value While Decreasing Chip Thickness:

One of the most challenging areas of competition among the high capacitance MLCC vendors is in chip thickness (T-Max). For years the standard thickness of a high capacitance MLCC, regardless of case size, was at 1.25 mm in height. However, over the past few years the increased demand from the portable electronics industry, and the need for electronic products to be thinner, has created demand for a decreased maximum height to 1.0 mm or less- down to 0.8 mm in thickness (with future roadmaps suggesting MLCC thickness at 0.5 mm at elevated capacitance values). This is a very challenging shift in demand because the height of the capacitor also contributes to its overall capacitance, so to limit the height without impeding capacitance is extremely challenging.

Summary and Conclusion:

Competition in the high capacitance multilayered ceramic chip capacitor market has become granular, with a wide variety of market opportunities for vendors who are first to market with variations on the traditional MLCC theme. These include ceramic capacitor chip case size, chip operating voltage, chip performance characteristic, and chip thickness; and the first to market with a product can enjoy up to a 6 to 24 month premium in price and profitability before the competition catches up and begins the tedious process of global price erosion. Future roadmaps for development suggest a continuation of a myriad of programs designed to increase capacitance, volumetric efficiency and operating voltages in MLCC at yield ratios that support increased dollars sales and profitability.

Dennis M. Zogbi

Dennis M. Zogbi is the author of more than 260 market research reports on the worldwide electronic components industry. Specializing in capacitors, resistors, inductors and circuit protection component markets, technologies and opportunities; electronic materials including tantalum, ceramics, aluminum, plastics; palladium, ruthenium, nickel, copper, barium, titanium, activated carbon, and conductive polymers. Zogbi produces off-the-shelf market research reports through his wholly owned company, Paumanok Publications, Inc, as well as single client consulting, on-site presentations, due diligence for mergers and acquisitions, and he is the majority owner of Passive Component Industry Magazine LLC.