Installed Capacitance: The Signature of the High Tech Global Economy

09/30/2014 //

Introduction

For the past 26 years, Paumanok Publications, Inc., has viewed the global market for capacitors on an annual basis based on the traditional methodology of the volume of units shipped by dielectric and their respective value of consumption. However, in this MarketEYE installment, we have decided to view the market based on annual demand for capacitance in microfarads as well as the cumulative demand of installed capacitance over time. Paumanok Publications, Inc.is in a unique position to generate useful data that shows (1) the global requirement for capacitance in microfarads on an annual basis between 1990 and 2014; and (2) the cumulative installed base of capacitance worldwide.

Methodology

For this exercise I reviewed numerous Paumanok studies on the capacitor market going back to 1990, and created spreadsheets showing production by component "case size" over time. Subsequently I created an average capacitance value per "case size" over time, which revealed that at specific time period, the capacitance value per cubic centimeter of specific capacitors, primarily ceramic chip capacitors and tantalum chip capacitors increased due to remarkable advances in the processing of raw materials; but also took into account thinner gage plastic films and thinner gage foils impacting capacitance in plastic film and aluminum electrolytic capacitors respectively. For this exercise, we also included only the four primary capacitor dielectrics- ceramic, tantalum, aluminum and plastic film capacitors and excluded double layer carbon, niobium, glass and other exotic capacitor dielectrics.

Results

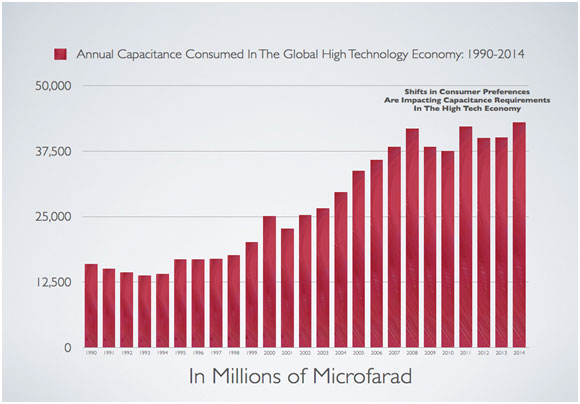

The global requirement for capacitance has increased accordingly with the advancement of three key technologies between 1990 and 2014 television sets, computers and wireless handsets; and while other product segments; such as telecom infrastructure equipment, automobiles, and various sub-products in the consumer audio and video imaging segment have had a major impact on global demand for capacitance, the combination of production volume of the end-product and the high amount of capacitance per board required in television sets, computers and handsets created a dramatic overall increase in the global requirements for capacitance between 1995 and 2008; after which and much to our surprise, capacitance demand plateaued due to changes in consumer preferences for end-products.

Graph 1.0

Annual Capacitance Consumed in the Global High Technology Economy: 1990-2014

Source: ©2014 Paumanok Publications, Inc. All Rights Reserved.

Changes in Consumer Preference for End-Products Impacts Capacitance Demand between 2008 and 2014:

Based on our detailed analysis, the reason why capacitance demand has leveled off on a global basis between 2008 and 2014 is a change in the consumer’s preference for end-products. The success and acceptance of the smart phone and the tablet, which requires a relatively small capacitance signature, continues to be at the expense of desktop computers, notebook computers and large screen TV sets, which require a large capacitance signature, and this has caused the global demand for capacitance to plateau (See Graph 1.0).

Certain Dielectrics Impact he Annual Capacitance Requirements More Than Others

One of the primary maxims associated with capacitor development is that the physical size, or available surface area of the capacitor is directly proportional to the capacitance value of the finished component. Therefore, what determines both the annual volume of capacitance sold, and the amount of the installed base for capacitance (See Graph 2.0); is the volume of capacitors sold by dielectric and the average amount of capacitance per capacitor. Ceramic capacitors, for example, have a huge quantity of pieces sold each year (exceeding 1 trillion) but their overall capacitance value per unit is limited to less than 100 microfarad, and their average capacitance value is in the single digit microfarad range. Aluminum capacitors on the other hand, have a fraction of the shipment volume of ceramic capacitors, but have an extraordinarily high amount of capacitance per unit; therefore, it is the volume of aluminum electrolytic capacitors sold each year that largely determines the total amount of capacitance sold worldwide. Tantalum capacitors also have an extremely high quantity of capacitance per unit, but their annual sales volume is much smaller than that of aluminum and ceramic capacitors. Plastic film capacitors have low capacitance per unit on average and a low comparative sales volume worldwide; and therefore contribute the least to the annual capacitance volume and installed capacitance base (plastic film capacitors are sold for their voltage handling capability and their unique smoothing characteristics).

Graph 2.0

Cumulative Capacitance Consumed in the Global High Technology Economy: 1990-2014

Source: ©2014 Paumanok Publications, Inc. All Rights Reserved.

Capacitance per Cell Does NOT Determine a Positive Return on Investment

Another interesting result of this exercise was that it showed that capacitance per cell alone does not determine the majority of market value in the capacitor industry; rather it is the combination of capacitance value AND the physical size of the finished capacitor that determines maximum market value and return on investment. Therefore, critical breakthroughs in ceramic capacitor manufacturing and in tantalum capacitor manufacturing have resulted in a greater return on investment for manufacturers of capacitors when compared to aluminum electrolytic capacitors or film capacitors, which have had limited comparative innovation with respect to volumetric efficiency over time.

Critical Breakthroughs in Ceramics and Tantalum Add to Installed Capacitance Base

Critical breakthroughs in raw material development for ceramic and tantalum capacitors have contributed to the annualized increases in capacitance consumed in the high-tech economy worldwide. The development of advanced ceramic dielectric material processing using alk-oxide, hydrothermal and sol-gel techniques have been instrumental in increasing the average capacitance value per unit in ceramic capacitors; while increases in capacitance value per gram of tantalum metal powder, through the removal of impurities and various melt techniques have also been and continue to be instrumental at increasing the capacitance value per cell for tantalum capacitors. This combination of increased capacitance per cell and smaller unit case sizes have helped boost capacitance value over time, especially in 1995, 2000 and at multiple occasions between 2003 and 2008.

What the Future Holds

As we have noted, the annualized demand for capacitance in digital circuits has leveled off between 2008 and 2014 (See Graph 1.0), and we can even see a slowdown in the growth rate of installed capacitance (See Graph 2.0). As we have noted, this is the result of changing consumer sentiment with greater interest in portable devices such as tablets and smart phones as opposed to capacitor intensive desktop and laptop computers. We believe that this plateau affect will continue to impact the industry until consumer sentiment changes and the requirements of the end-user modify from basic internet and streaming video access to more advanced computing requirements. The dollar value in the industry will continue to be focused on developments that increase capacitance while decreasing the physical size of the finished component.

Dennis M. Zogbi

Dennis M. Zogbi is the author of more than 260 market research reports on the worldwide electronic components industry. Specializing in capacitors, resistors, inductors and circuit protection component markets, technologies and opportunities; electronic materials including tantalum, ceramics, aluminum, plastics; palladium, ruthenium, nickel, copper, barium, titanium, activated carbon, and conductive polymers. Zogbi produces off-the-shelf market research reports through his wholly owned company, Paumanok Publications, Inc, as well as single client consulting, on-site presentations, due diligence for mergers and acquisitions, and he is the majority owner of Passive Component Industry Magazine LLC.