How a Small Change in Technology Resulted in $7 BB in Value-Add - A Component Success Story

01/16/2017 //

Supply Chain Uncertainty

For ceramic capacitors, the future of the supply chain seemed murky back in 1993. A keen reliance on palladium electrodes for multilayered chip versions at that time meant the supply chain would be dependent upon a “precious” metal as demand from computers, cellular phones and home theatre electronics began to blossom.

This was the setting that prompted a radical change in capacitor inner-electrode technology. This change, which was originally embarked upon out of necessity and with great reluctance, produced one of the most successful and innovative technology platforms developed in the past 30 years, one that truly enabled the advancement of form and function of portable electronics, and resulted in an additional value-add into the global electronic components supply chain of an additional $7 BB USD.

The Volatility in the Price of Palladium Results in Action and Investment

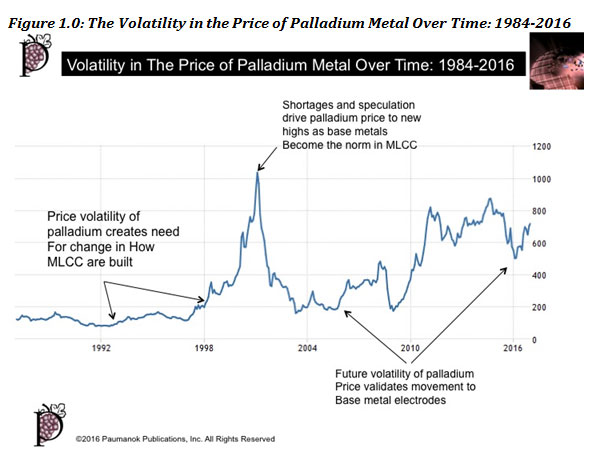

In the early 1990s, all multilayered ceramic capacitors were, by today’s standards large case size products, with the 1206 Electronic Industries Association (EIA) designated case size as the leading edge in volumetric efficiency, and the multilayered capacitors were built like they were, all mission critical (once again by today’s standards). This all-encompassing exotic solution included the use of palladium electrodes in ceramic chip capacitors, which in Japan was all high-fire sintering of ceramic green sheets, which required high palladium loading content in the inner-electrodes of at least 80%. As Figure 1.0 below suggests, the price of palladium has demonstrated unusual pricing over time with significant peaks and valleys. This volatility caused ceramic capacitor manufacturers in Japan to offer the world an alternative based upon base metals (BME MLCC) such as nickel.

MLCC Unit Demand Skyrockets

As the market began moving upward at a rapid rate, where adding 100 to 150 billion MLCC pieces per year in global capacity would be required, the market outlook became “cloudy” because it was subject to financial speculators and traders who invested in the Platinum Group Metals supply chain, with emphasis on palladium, and who had their own agenda about how to make money. Their methods and interests were not necessarily in alignment with the success of the high-tech economy. It was then that there was clear and deliberate action from Japanese component vendors to displace palladium-bearing electrodes with nickel. This was a major undertaking, but Japanese component manufacturers and American, European and Japanese materials suppliers attacked the problem with vigor.

Necessity is the Mother of BME MLCC Invention

While a case can be made that BME MLCC were first developed as far back as 1972, it was mass produced and introduced into the Japanese market in 1993 and by 1998 had infiltrated every segment of the massive MLCC market. This included the use of base metal electrodes in Y5V, X7R and NPO dielectrics. Affectively sustaining palladium demand as an unchanged data point while creating a huge demand for nano-sized nickel particles, and their copper termination and ceramic dielectric material matching systems.

Minor Changes Yields Huge Results

The reader should appreciate that these small changes in ceramic technology resulted in the augmentation of an existing $3 billion industry with an additional $7 billion in U.S. dollar value, to create a $10 billion global industry supplying capacitance for all products. It’s a remarkable achievement, and in fact its development can be traced to specific manufacturers of chemicals and their synthesis into engineered powders and pastes. Some of these developments were from merchant vendors and some were from trade manufacturers of components, and some came from academia working in conjunction with these groups. But there was a collective movement in information, materials and platform technology that occurred in a relatively short period of time, with, what in my opinion, was a critical lesson in how technology moves successfully. In Japan, manufacturers of nickel powders were so much more advanced than manufacturers of ceramic powders because they had the massive battery industry revenues backing them up, and they had quickly achieved materials that could be useable by the MLCC industry to make visionary “next-generation” components that added capacitance and increased volumetric efficiency.

One Change Leads to Others

The other problem was the required development of matching systems. This required in-house knowledge of two disparate industries, metals and ceramics (who only meets lucratively in electronics), and required the two to be compatible with each other chemically and during processing. This required three separate technology centers to work together to formulate a component solution- ceramics, metals and component processing (equipment); and create a platform for new product development in the future. All of this was achieved because of the size of the existing market at the time, the rapidity of its growth, and the future potential the technology held in competing against competing electrostatic and electrochemical capacitor designs.

In the end, ceramics prevailed because its raw materials had been moved to ubiquitous materials supply chains that were in large supply and not dependent upon electronics (i.e. barium, titanium, nickel, copper), and each painful and miniscule development resulted in large-scale return on investment for the vendors involved.

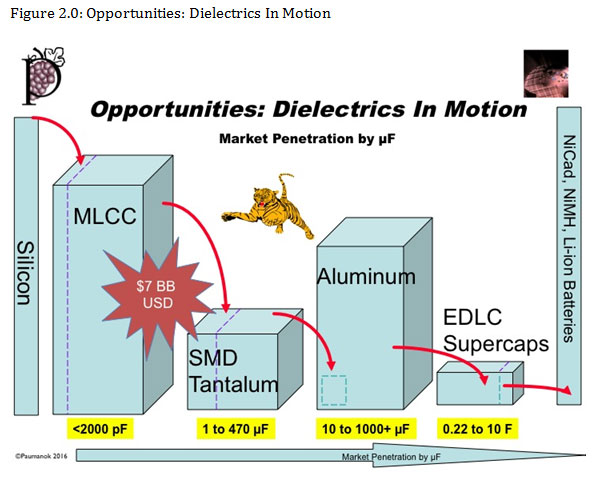

Opportunities: Dielectrics in Motion Primary manufacturers of materials and capacitors in Japan point toward the fact that the development of base metal electrodes were almost exclusively as a reaction to the volatility in price for palladium metal. It was not until later on that it was realized that with base metal electrodes and ceramic dielectric and termination matching systems that higher capacitance MLCC could be developed that could compete with electrochemical capacitors. And then like a pebble tossed into a pond, the resulting ripples impacted the established products with which it competed- primarily tantalum capacitors which were the go-to product for high capacitance in portable electronics. It is important to appreciate the critical juncture in the story, which was October 1995 when a major global handset manufacturer forecasted that the need for solid tantalum capacitors would be extra-ordinary to support the future growth of communications, computing and entertainment; but it was not to be; the lower cost base metal capacitors had been mass-produced in Japan at high capacitance and in ultra-small case sizes; but most importantly at a lower price per gram of capacitance than tantalum, in its narrow, precarious supply chain, could afford.

It was a huge windfall for ceramics, resulting in a $7 billion in value-added for the ceramic capacitor industry between 1996 and 2016. Not to be outdone, and for grand comparison, arises the metals industry in Japan, USA and Germany to push back with nano-technology of their own, with or as one of the world’s top tantalum scientists at the time noted, “The development of high capacitance value per gram tantalum powder was the direct response to high capacitance MLCC coming out of Japan.” So ultimately, the volatility in the price of palladium, largely the result of financial speculators, resulted in the development of alternative electrode technologies based upon nickel powder and paste. One can argue that this development of high capacitance MLCC was based entirely on necessity; but a necessity brought about by significant foresight into the direction the high-tech economy would take after 1995, plus it required significant investment in capital equipment and new materials. But the tantalum supply chain soon realized that the cost structure of ceramics, based upon titanium dioxide and barium compounds was less expensive and more readily available when compared to tantalum, and the shift to nickel secured their materials costs would be much more affordable than tantalum. The tantalum supply chain invested in nano-technology of its own, creating their own higher capacitance products and competing against aluminum electrolytic capacitors, who in turn focused on double layer carbon and lithium-doped supercapacitors, whereby the surface area of the dielectric was so overwhelming complex as to be able to offer tremendous energy density (See Figure 2).

Source: Paumanok Publications, Inc. 2016 Presentation On Dielectric Materials. This chart illustrates a similar trend analysis and is described as “Dielectrics in Motion.” Advances in silicon technology are currently attempting to encroach on ceramic chip capacitors by employing ion implantation devices used for semiconductor manufacturing to create silicon dioxide and silicon nitride capacitors at the angstrohm level. MLCC are moving up the food chain in capacitance by competing against tantalum chip capacitors and surface mount aluminum capacitors between 1 and 470 microfarad, at the same instance, double layer carbon supercapacitors are extending the capacitance range into the farad realm and subsequently competing against secondary batteries. This process is the result of the continued advancement in the manipulation of dielectric materials and how they are constructed into a finished component.

How to Gain Future Insight

It is a good lesson for any high-tech corporation to allow a small percentage of overall engineers within any organization to be engaged in cutting edge experimentation that requires them to look for new ways to create new products for the company. The initial process phase is usually “Blue-Sky” dreaming and establishing a new product based on what the engineer thinks might work. After initial laboratory experimentation the process reaches a stage where more complex testing is warranted. After all initial stages of testing are done it is determined if the process can be put into pilot production, and at that stage the process leaves the engineers and goes to corporate administration to determine if the economics are sound. It is my experience that the process flow from concept to commercialization takes about five years.

Summary and Conclusions

The development of high capacitance ceramic chip capacitors were the direct result of a fear that the continued volatility in palladium would negatively impact the manufacturers cost to produce over time and subsequently it resulted in the development of base metal electrodes based upon nickel to displace palladium. The future developments of matching dielectrics and termination resulted in the development of products that could compete against higher capacitance products that were usually reserved only for the electrochemical capacitor segment- primarily tantalum. This also resulted in the push back by tantalum and the creation of alternative materials technologies that created higher capacitance products in increasingly smaller case sizes. And this development in tantalum had a ripple effect on other capacitor dielectrics, including aluminum and double layer carbon supercapacitors.

Dennis M. Zogbi

Dennis M. Zogbi is the author of more than 260 market research reports on the worldwide electronic components industry. Specializing in capacitors, resistors, inductors and circuit protection component markets, technologies and opportunities; electronic materials including tantalum, ceramics, aluminum, plastics; palladium, ruthenium, nickel, copper, barium, titanium, activated carbon, and conductive polymers. Zogbi produces off-the-shelf market research reports through his wholly owned company, Paumanok Publications, Inc, as well as single client consulting, on-site presentations, due diligence for mergers and acquisitions, and he is the majority owner of Passive Component Industry Magazine LLC.