Capacitor Raw Materials: Outlook On Availability and Continuity of Supply

07/11/2017 //

Introduction

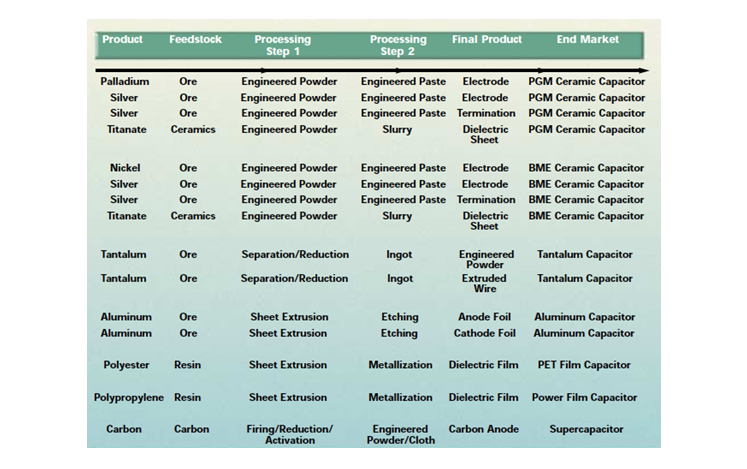

There is a scientific principle that ensures the economic viability of the global merchant market for raw materials consumed in capacitors: capacitance is directly proportional to the physical size of the finished capacitor, which can also be interpreted as “available surface area.” Therefore, capacitors are a raw material intensive industry. In fact, Paumanok Publications, Inc., estimates the global value of primary materials consumed in the global fixed capacitor industry at $5.6 billion worldwide in 2017. The following chart (Figure 1.1) illustrates the various raw materials consumed in the production of capacitors on a worldwide basis. Moreover, and directly to the recent extension of capacitor leads times- in order to achieve desired capacitance, capacitor manufacturers use one of three manufacturing methods: stacking, winding or pressing. The final manipulation of the dielectric in an attempt to make it a usable capacitor body, subject to the volumetric efficiency restraints of modern electronic designs; the capacitor materials conversion process may further enhance the active surface area of the dielectrics described below from which capacitance is derived by advanced-engineered raw materials through milling, etching, metallizing or other exotic means.

Figure 1.1: Primary Raw Materials Consumed in The Capacitor Industry: 2017

Source: Paumanok Publications, Inc.

Ceramic Metallization and Dielectric Materials

Ceramic capacitors employ metallization in the electrode and termination. The electrode materials may be palladium, palladium + silver, nickel or copper; the termination materials may be silver, copper, palladium + silver or platinum + silver. The dielectric materials consumed in ceramic capacitors are based primarily upon barium carbonate and titanium dioxide compounds, which are mixed to form barium titanate and a variety of other ceramic-based dielectric materials.

PGM Ceramics

PGM ceramic capacitors are those capacitors with electrodes made from platinum group metals (PGM), which means they contain palladium. PGM ceramic capacitors will have either 100% palladium electrodes, 70% palladium electrodes or 30% palladium electrodes (or a variation of the loading), with silver as the balance. The terminations employed in PGM ceramic capacitors are predominantly silver electrodes, although a small percentage of ceramic capacitor terminations include palladium + silver and platinum + terminations.

Ceramic dielectric materials consumed in PGM ceramic capacitors are typically solid-state ceramic materials, and some variation on the barium carbonate + titanium dioxide theme. Primary raw materials consumed in the production of PGM ceramic capacitors account for 60% of the total value of the worldwide PGM ceramic capacitor market.

This is, of course, the result of the extraordinary price of palladium in 2017, which at an average annualized rate of $860.00 per troy ounce, represents up to 50% of the cost of the PGM ceramic capacitor in high fire systems. This cost is quite prohibitive and totally noncompetitive against ceramic capacitors produced with base metal electrodes such as nickel, which dominate the lucrative high capacitance portion of the MLCC business in 2017 and where the bottleneck in production is causing worldwide extensions of lead times.

The outlook for PGM ceramic materials, which are ultimately consumed in the more mission critical applications such as under-the-hood, aerospace, medical, oil and gas, satellites is that costs will increase in accordance with the volatility of palladium electrode materials and silver terminations, which are markets that are more controlled by the outcome of other markets, most notably the catalytic converter markets in automobiles.

BME Ceramics

Ceramic capacitors produced with base metal electrodes (BME) employ primarily either nickel in their electrodes or copper (for high frequency). Ceramic capacitors produced with nickel electrodes require copper terminations. Due to the extremely high price of palladium, many companies producing ceramic capacitors (especially those with high levels of palladium in their electrodes) have transferred their production to nickel based electrode systems.

Merchant market sales of raw materials to the BME ceramic capacitor industry have grown dramatically over the last twenty years and will continue to grow at a healthy rate over the next five years as more emphasis is placed on improving yields and profitability for the MLCC market from 100 to 470 microfarad. In such high capacitance markets, base metal electrodes are such an attractive alternative to using palladium-bearing electrodes. Of course, the capital equipment costs required for entry into the BME ceramic capacitor industry are much more expensive when compared to capital equipment for production of PGM ceramic capacitors. Plus, there are hidden costs in BME ceramic capacitor production, such as higher dielectric material costs associated with the advanced titanate materials required to produce extremely thin dielectric layers as well as additional costs associated with nitrogen and related gases. Nevertheless, since palladium feedstock is 56 times more expensive than nickel feedstock, it makes tremendous economic sense for companies to transfer their production from palladium to nickel-based material systems especially when producing MLCC from 2.2 microfarad to 470 microfarad where the number of layers required is substantial and the amount of fine nickel consumed per case size is comparably substantial.

Paumanok’s recent analysis of ceramic dielectric materials and nickel electrode powders concluded that the merchant market supply of alk-oxide generated particles and hydrothermal particles in ceramics is more advanced than the industry can handle and the bottleneck remains in the stacking of thousands of layers per chip. The yield ratios continue to be difficult to attain profitability and therefore MLCC manufacturers are extending lead times so they can continue to maintain high levels of component output quality. A major Japanese manufacturer of MLCC noted that many companies were starting to design in MLCC above 100 microfarad under the assumption they were standard parts and not really considering they might be difficult to manufacturer because they were so comparably inexpensive to other components on the printed circuit board.

Materials supply and technology in BME ceramic raw materials remains ahead of its time. According to Paumanok’s benchmark analysis there have been improvements in the generation of ceramic particles using alk-oxide chemical processing methods, while hydrothermal titanates are also key for the production of MLCC above 100 µF. With respect to feedstocks for barium titanate, including titanium and barites remain in large supply because electronics are just a small part of their consumption by end-use market.

Tantalum

Paumanok Publications, Inc., estimates that the primary raw materials consumed in the production of tantalum capacitors are capacitor grade tantalum metal powder and wire. Tantalum is a hot topic in 2017 due to the fact that the Dodd-Frank Act, which includes a “Conflict Minerals Clause on Tantalum” may be repealed with no replacement of any form of conflict minerals ruling. This would remove some of the added costs associated with industry compliance regarding various levels of required verification to ensure that no value-added providers in the tantalum supply chain are profiting from minerals derived from conflict regions.

Tantalum is mined as ore, then sold to intermediate producers of capacitor grade tantalum metal powder and wire, who separate the pure tantalum from the various other elements found in conjunction with the metal. Tantalum capacitor grade powder is produced by limiting the impurities (such as oxygen, potassium and nitrogen) in the mixture, so that a high degree of tantalum purity is inherent in the final anode so that when it is coated with the cathode material that it creates an ideal layer of dielectric. Tantalum wire is produced through traditional methods of wire drawing. The powder and wire is sold to the capacitor manufacturers, who in turn press the powder into anodes. They then fire the anodes and attach the tantalum wire lead to the anodes by direct weld. The surface area of the tantalum anode pellet is increased due to its porous nature.

The outlook for tantalum materials is positive because this special metal overlaps in its capacitance values with high cap BME MLCC and are therefore subject to growth based simply on its known performance characteristics as tantalum-pentoxide (Ta205) dielectric layer and their ultra-small case size and forty year performance in critical electronics. What’s more is that the material has multiple mine sources globally. Paumanok believes that tantalum capacitor manufacturers may be in the unique position to vertically integrate their entire supply chain down to the mines and not only have the capability to control the radioactivity levels of ore, but to begin to apply some of the more advanced high CV/g powders producing by flame synthesis that may create new solid capacitor designs in the 680 to 1000 microfarad range.

Aluminum

Aluminum capacitors require a variety of raw materials in their construction, including etched anode foil, etched cathode foil, separator paper (usually Kraft-Type or manilla paper), and electrolytes (typically, ethyl glycol). However, these raw materials have comparably lower pricing than most alternative dielectric materials on a pound-for-pound basis. Etched anode foils represent the most expensive component involved in aluminum capacitor construction, followed closely by etched cathode foils. This fact explains why most of the larger aluminum capacitor manufacturers have in-house capabilities to produce their own etched anode and cathode foils, which ultimately helps the capacitor manufacturer to control costs. Rolls of etched anode and cathode foil are rolled together with the Kraft-type or Manilla-type paper, separating the two metal foils. The paper is very esoteric in design and is soaked in the electrolyte, and the entire cell is placed in an aluminum can with lead wires attached and gaskets placed atop the can.

The outlook for aluminum and its feedstock material-Bauxite remains positive as it is expected to eventually experience growth in electronics through the revival of the renewable energy business. Aluminum remains in abundant supply and its price, while subject to variations, remains relatively stable over time and remains well below its 2008 highs. Aluminum consumption should remain at a steady state of growth as more of it is used in automotive bodies of the future.

DC Film

DC film capacitors are manufactured primarily from metalized polyethylene terephthalate (PET) plastic film, which gets exceedingly more expensive as the dielectric material decreases in thickness. Extremely thin polyester films which are used in the construction of surface mount film capacitors may cost as much as $130.00 per pound, metalized. DC film capacitors are manufactured from PET resins (which extrude very thin) and are then metalized to increase their surface area in the finished capacitor. DC film capacitors are manufactured by winding the polyester film on a winding machine and encapsulating the rolled film cell in plastic, or by stacking up interleaving layers of thin dielectric film.

The availability of PET film for the capacitor industry is assured as the material is one of the most common thermoplastic polymer resins used, with its primary consumption in bottling and plastic packaging of food and beverages. Because of the massive quantities of soda bottle produced from PET for example, the average price per pound for the resin has remained steady. The cost factor in film capacitor production, once again, increases proportionately based upon the thickness of the film being purchased. Since capacitance increases with available surface area, thinner films are desired for products that must adhere to strict volumetric efficiency requirements of the finished capacitors.

AC Film

AC film capacitors are predominantly polypropylene in their dielectric construction. A significant quantity of polypropylene is used per capacitor because power film capacitors tend to be physically large (We actually dichotomize the markets at Paumanok based upon “large cans” which implies utility grade power transmission and distribution capacitors, and “small cans” which implies the motor run capacitors. Polypropylene consumed in power film capacitors is much thicker when compared to polyester consumed in DC film capacitors and therefore costs less money per pound. However, about twice as much polypropylene film is consumed in the capacitor market when compared to polyester film, consequently, the value of the markets is similar. Power film capacitors are manufactured by winding the polypropylene film into a cell and placing the cell into a can. Sometimes the cell may contain aluminum foils or even separator papers (similar to aluminum capacitors).

Polypropylene is abundant in the market because of its primary use in plastic packaging for food containers. It has been used as a capacitor dielectric for almost 50 years and is the mainstay of the “electrical” capacitor industry because of its excellent performance at high voltage. The availability of polypropylene is assured going forward, although the key polypropylene feedstock material – propylene, has proven to be in short supply in 2017. The price of polypropylene therefore has been turbulent in both 2016 and 2017, with prices dropping in the fourth quarter of 2016, followed by a sharp price increase in the first quarter of 2017.

Activated Carbon

Activated carbon materials consumed in the production of double layer carbon “supercapacitors” come in two forms: activated carbon powder “microbeads” and activated carbon cloth, both of which have extremely high surface areas but extremely different price tags. The majority of carbon consumed in supercapacitors is the lower cost powdered microbeads, which are pressed into anodes and used in applications typically less than one farad. Carbon cloth is primarily consumed for extremely high capacitance supercapacitors greater than one farad and up to 3,000 farads, and is a wound construction.

Supercapacitors are manufactured by extruding the carbon into a pellet, then placing the pellet into a plastic or metal housing. Wound supercapacitors that employ carbon cloths are wound in a similar fashion to the aluminum capacitor.

Activated carbon materials are an interesting subset to the capacitor industry because its dielectric can in fact be manufactured from organic source materials such as nuts and seeds. In the capacitor supply chain however, most finished anode are constructed from synthetically produced activated carbon micro-beads or cloths which are manufactured into anode cells or into wound capacitors. Activated carbon is used primarily as a filtering agent, and its use as a dielectric remains comparably small to the other dielectrics, but its upside potential as a power augmentation device for load leveling suggests it has a bright future.

Summary and Conclusions: Capacitor Materials and Outlook: 2017-2022

The outlook for capacitor materials remains robust with Paumanok Publications, Inc. expecting that high capacitance BME MLCC and Solid Tantalum Capacitors will be the two most active capacitor dielectrics over the next five years because portable electronics just pivoted away from a model of penetration by world population to a theatre of increased hardware functionality.

Therefore, any type of solid capacitor, even plastic film chip capacitors in PEN, PET and PPS dielectrics, polymer aluminum chip capacitors employing the finest and most purest anode foils; and activated carbons, (especially grapheme) will have opportunities as the value that had been placed into the global expansion of smartphones by population gets re-focused on increasing the functionality of the hardware.

Dennis M. Zogbi

Dennis M. Zogbi is the author of more than 260 market research reports on the worldwide electronic components industry. Specializing in capacitors, resistors, inductors and circuit protection component markets, technologies and opportunities; electronic materials including tantalum, ceramics, aluminum, plastics; palladium, ruthenium, nickel, copper, barium, titanium, activated carbon, and conductive polymers. Zogbi produces off-the-shelf market research reports through his wholly owned company, Paumanok Publications, Inc, as well as single client consulting, on-site presentations, due diligence for mergers and acquisitions, and he is the majority owner of Passive Component Industry Magazine LLC.