Passive Electronic Components for The Defense and Aerospace Sector in 2017

11/07/2017 //

Structure of The Global Defense Electronics Sector in 2017

This MarketEYE article describes the structure of the defense and aerospace electronics sector as an end-use market segment for electronic components such as capacitors, resistors and inductors. The market has been stagnant from 2012 to 2014 due to government imposed sequestering in the United States, but in 2015, 2016 and 2017 this market has shown signs of a substantial recovery driven largely through demand for commercial aircraft and space electronics.

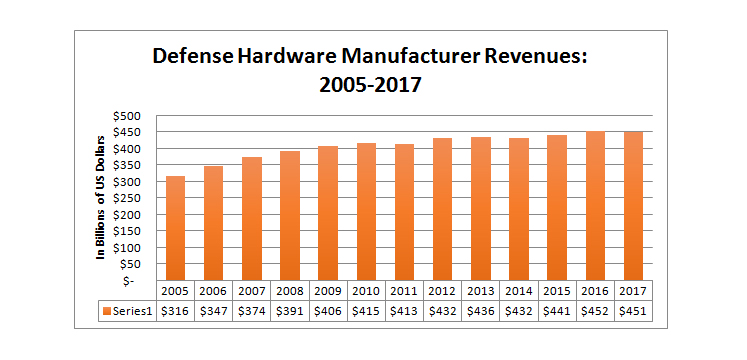

Global Spending on Defense and Aerospace Electronics: 2005-2017

Revenues generated by the top global manufacturers of defense electronics between 2005 and 2012 were substantial, but they leveled off and then declined with the government imposed sequester in the United States until 2015, and then experienced an overall market increase in 2016 and stable environment in 2017.

Figure 1: Defense Hardware Manufacturer Revenues: 2005-2017

Source: Paumanok Publications, Inc. A combined index of revenues for the following companies- The Boeing Company; Airbus (EADS), United Technologies, Lockheed Martin, General Dynamics, BAE Systems, Northrop Grumman, Raytheon Company, Leonardo SpA, Thales, L-3 Technologies, SAIC, Rockwell Collins, Orbital Sciences Corp, Crane and Loral.

Passive Component Consumption in Defense Electronics: 2012-2017

The passive component segment for defense electronics includes capacitors, resistors and inductors. Within those sub-categories, ceramic capacitors are the most preferred product line, followed by tantalum capacitors, although plastic film capacitors and aluminum electrolytic capacitors are also consumed in the defense and aerospace sector as well. IN resistors, the defense and aerospace segment consumes a myriad of ruthenium based chip resistors and networks, as well as nichrome metal film, tin-oxide and bulk metal foil resistor products; and wirewound resistors for power. In discrete inductors, consumption of molded chip and wirewound axial and radial leaded inductors is noted in defense and aerospace electronics. Capacitors are consumed for bypass, filtering and decoupling applications, but are also consumed in pulse discharge applications for radar circuits, munitions and railguns. Resistors are consumed in almost all defense platforms, and the segment prefers the use of nickel chromium in film, wire and foil formats because of its operational reliability and resistance to moisture. In discrete inductors for defense, the majority of products are consumed for noise abatement in communications and navigational equipment only.

Passive electronic component consumption value for applications in defense and aerospace electronics experienced a different pattern of consumption in electronic subassemblies in the sector since 2012. In fact, market data derived from the financial reports and statements of the key passive component vendors to the defense and aerospace sector- including such vendors as KEMET, AVX, and Vishay, who break out the defense and aerospace sector in a measureable way in their annual report and 10-K statement for each company respectively and we have determined that consumption of defense and aerospace capacitors, resistors and inductors declined from 2012 to 2016 and has only experienced a turnaround in 2017.

Fastest Growing Companies In Defense Electronic Sub-Assemblies & Platforms: 2012-2017

The world’s top manufacturers of commercial and defense aircraft drive demand for defense and aerospace electronics. Companies such as Raytheon and Rockwell Collins build products that are passive component intensive and are in turn consumed by other defense manufacturers such as The Boeing Company, Airbus and Lockheed Martin.

Boeing and Airbus are the largest manufacturers on the defense and aerospace manufacturers list and both companies account for about 39% of the defense electronics spend for the world for 2017 combined. Other major platform manufacturers such as Lockheed Martin, General Dynamics, BAE Systems, Northrop Grumman and Raytheon are also key customers for electronic components.

Customers in the sector that are showing the fastest growth rates for 2015, 2016 and 2017 include Lockheed Martin, BAE Systems, Northrop Grumman, Thales, L-3 Technologies, Rockwell Collins and Orbital Sciences Corp.

Passive Electronic Component Intensive Defense Platforms

The defense end-market represents the largest single end-market for “Value-Added and Application Specific Passive Electronic Components.” The primary circuit applications in defense electronics are:

- Power Supplies

- Communication and Navigation

- Computing and Networking

- Displays and Controls

- Munitions

- Optics and Sensors

In many instances, the following criteria are required of the components consumed in the defense and aerospace sector:

- High Voltage >500 Vdc

- High Frequency >1 GHz

- High Temperature >175 C

- Low Temperature < -55 C

- Harsh Environment Operation

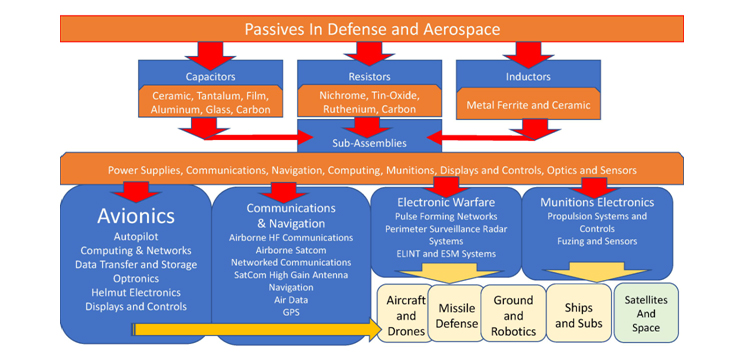

The categories can further be broken down into multiple supply chains. Paumanok uses the following portfolios of the major defense manufacturers to guide the core sub-sets where passive components are consumed as follows.

Figure 2: Passive Component Supply Chain For Defense and Aerospace Electronics: 2017

Source: Passive Electronic Components in Defense and Aerospace Electronics: 2017-2022

Avionics

Communications, navigation, display and multisystem management, when combined together form the core subset of the defense and aerospace electronics segment known as avionics. Avionics uses open systems architecture (OSA) and commercial off-the-shelf (COTS) technology to best meet system requirements within budget.

Autopilot

Automatic flight controls are required to perform reliably in all types of flight situations to reduce pilot distraction and fatigue on long haul flights. Also, the unmanned military drone technology also employs autopilot technology, including single and multiple redundant configurations, providing automation along with both reliability and electronic safety features.

Computing & Networks

Computer motherboards consumed in avionics platforms are constantly being pushed to deliver higher performance, functionality, reliability and efficiency while decreasing size, weight, power and cost.

Data Transfer and Storage

Modern aircraft require data storage to manage information loads that provide greater processing power and local area network capabilities. Microprocessor-based data storage solutions support increased data transfer while maintaining compatibility with existing aircraft data recording sources, while also permitting access to worldwide databases.

Optronics

Precision optical assemblies rely on high performance electronics in extreme temperature and vibration environments for military, commercial and space applications. Tactical and simulation helmet-mounted displays are an extension of this market.

Precision Optical Assemblies

High-performance optical subassemblies spanning the entire spectrum from deep ultraviolet to far infrared, and account for virtually all materials suitable for opto-mechanical applications during space flight.

Simulation and Training Helmet-Mounted Displays

Head and helmet mounted displays provide superior realism for virtual reality, simulation and training applications.

Aircraft Networks

As military aircraft avionics become more sophisticated, there is a greater need for increased secure data bandwidth across local area aircraft networks.

Displays and Controls

Display technology is becoming more sophisticated in today’s defense and aerospace end-markets and includes the following types of established and emerging display markets in 2017.

Control Display Units (CDU)

Battle-ready military avionics require rugged, military-grade control display units (CDU). This consolidates control of communications, navigation, weapons and defensive aids to provide pilots with maximum effectiveness.

Head Down Displays (HDD)

Advanced multifunction HDD displays include a full range of sizes and configurations for forward-fit or retrofit applications. Full-color-graphics video and night vision- and sunlight-compatible displays expand the capability and utility of the flight deck. Industrial grade, commercial off-the-shelf technology components and designs are used in this application.

Heads Up Displays (HUD)

HUD electronic displays work with the pilot’s eyes focused out in front of the aircraft viewing the presentation of flight path, flight path acceleration, visual glideslope angle and the runway aim point.

F-35 Gen III Helmet Mounted Display System (HMDS) (Cover Art)

The F-35 Gen III Helmet Mounted Display System’s next generation interface provides pilots with intuitive access to vast quantities of flight, tactical, and sensor information for advanced situational awareness. The next-generation user interface serves as the pilot’s primary display system, and virtual capabilities enable them to see through the bottom of the fuselage or directly at a target. With an uninterrupted display of flight information and sensor data, the pilot experiences extreme spatial orientation and superior weapons targeting–both day and night.

Communications & Navigation

Modern military communication systems provide advanced platforms that span the operational spectrum and include the following sub-categories.

Airborne High Frequency Communications

Airborne HF Communications equipment includes Beyond the-line-of-sight (BLoS) systems. Today, modernized Wideband HF (WBHF) can deliver rates up to 240 kbps on a 48 kHz wide channel, opening the door for HF to deliver the same level of data transmission speeds, quality and security as narrow-band SATCOM systems.

Airborne SATCOM

To ensure high-speed global communication- a full range of seamless satellite-based global voice and data communication systems for military platforms are also employed.

Networked communications airborne radio

Two-channel networked communications airborne radio is the latest software defined radio receiver-transmitter for defense.

SATCOM High Gain Antenna

The High Gain Antenna offers a low profile, electronic steering and phased array. It also complies with Inmarsat requirements for high-gain service and optimizes Swift Broadband operations. The antenna contains an integrated beam-steering unit and receives command information directly from the Satellite Data Unit.

Navigation

Navigation and guidance solutions for airborne systems, precision guided munitions, handheld receivers and embedded applications are required in the defense and aerospace sector.

Air Data

Air data technology calibrates airspeed, Mach number and altitude, as well as altitude-trend data.

Ground Communications Products

Global Positioning System (GPS) devices for ground-based missions provide pinpoint accuracy in mobile and even handheld form factors.

Micro GPS Receiver Application Module

The Ultra-small GPS Module provides situational awareness through the application of embedded data-processing. Portable, versatile GPS receiver provides precision guidance capabilities for vehicular, hand-held, sensor and azimuth determination applications.

Airborne VHF/UHF/L-Band

Ground and airborne military forces and civil agencies depend on reliable and secure air-to-ground network connectivity to share critical intelligence. A wide range of networked airborne communication radios operating in the VHF, UHF and L-band frequencies are required for this task.

High-speed Transceiver

The High Speed SATCOM Transceiver is a communications component important to defense communications. SwiftBroadband channel. Additionally, the HST is equipped with Ethernet, ISDN, ISDN over Ethernet and RS-232 interfaces, and can be installed inside or outside the pressure vessel for maximum installation flexibility.

Perimeter Surveillance Radar Systems

High-performance perimeter surveillance radar system features Frequency Modulated Continuous Wave (FMCW) advanced radars and combines all functionalities required for ground-based perimeter surveillance.

Electronic Warfare and Radar

Electronic Intelligence (ELINT) and Electronic Support Measures (ESM) have been developed to keep pace with rapidly evolving radar technology and the increasing congestion of the electromagnetic spectrum (EMS). Radar systems use pulse discharge technology and require large electronic components that can operate at high voltage and high frequency in harsh environments.

Munitions Electronics

In the market sub-segment known as munitions electronics, we see the primar6y areas of consumption of electronic components in power supply (Power up) and in pulse discharge detonation circuits.

Propulsion Systems & Controls

Propulsion systems for tactical missiles, missile interceptors, launch vehicles and spacecraft are included in this sub-category and is an important area of high-temperature electr9onic component application. These are powered by solid and “green” liquid propellants, as well as air breathing and hypersonic propulsion technologies.

Fusing and Sensors

Bomb fusing and proximity sensors detect the height of a weapon above a target and operate in an electronic countermeasure environment. Fuse portfolios include electronic and electro-mechanical bomb fuses that are capable of penetrating deeply buried targets, engaging high speed, maneuverable surface threats, and delaying detonation.

Satellites

Communication Satellites

The market requires 1.5 - 5.5 kilowatt commercial geosynchronous (GEO) communications satellites and Low Earth Orbiting Satellites used to provide direct-to-home TV broadcasting, cable program distribution, business data network capacity, regional mobile communications and similar services have been the boom market in 2017 as the commercialization of space promises the launch of thousands of small satellites in 2018.

Imaging Satellites

Commercial Earth imaging services is big business. This innovative series of spacecraft paved the way for today’s space-based commercial Earth imaging industry.

Summary and Conclusion

The defense and aerospace electronics sector represents a significant part of the value added and application specific segment of the passive electronic component supply chain. Because of its small size (i.e <$500 MM US Dollars in capacitor, resistor and inductor sales to defense worldwide), this segment of the market undergoes limited scrutiny and yet it requires capacitors, resistors and inductors that can operate at high temperature, high frequency and/or high voltage applications in multiple fragmented subassemblies primarily in avionics, communications, munitions and computing. This article attempts to shed light on the fragmented nature of this mission critical supply chain.

Dennis M. Zogbi

Dennis M. Zogbi is the author of more than 260 market research reports on the worldwide electronic components industry. Specializing in capacitors, resistors, inductors and circuit protection component markets, technologies and opportunities; electronic materials including tantalum, ceramics, aluminum, plastics; palladium, ruthenium, nickel, copper, barium, titanium, activated carbon, and conductive polymers. Zogbi produces off-the-shelf market research reports through his wholly owned company, Paumanok Publications, Inc, as well as single client consulting, on-site presentations, due diligence for mergers and acquisitions, and he is the majority owner of Passive Component Industry Magazine LLC.