High Voltage MLCCs for Battery Electric Vehicles: Global Markets and Opportunities, 2021-2025

12/10/2020 //

There is a measurable correlation between the rate at which nations attempt to achieve carbon emissions goals and the rate at which they develop electric vehicles. Many of these emissions goals have been set for the year 2025, which means that a significant boost in the demand for components that enable such reductions is well underway.

Unique Electronic Components Requirements in Automobiles

Historically, the capacitance requirements for automobiles propelled by internal combustion engines have largely been accomplished by multilayered ceramic chip capacitors (MLCC) for decades, due to the robust nature of the ceramic capacitor design. Automotive-grade MLCCs provide design engineers with a product that offer capacitance at high temperatures and that withstand high vibration frequencies and exposure to harsh chemicals from the engine or the road.

For an MLCC vendor to achieve automotive certification – or, more importantly, for a component manufacturer to offer a product line that is attractive to an automotive electronics company – the vendor requires certain economies of scale to produce the component, and must possess the technical expertise in-house to develop dielectric, electrode and termination materials that are suitable for an automotive environment.

From a market perspective, only a few advanced electronic component companies have catered to large automotive customers. Those companies have used this sales funnel successfully to create market leaders in the United States, Germany and Japan. However, the relationship between automotive company and electronic component manufacturer was traditionally strained due to the pressure placed on electronics in the automotive environment, and due to the strict and aggressive purchasing tactics of the large engine producers and the producers of infotainment electronics.

This technical, volume and limited return on investment value proposition has kept vendors of automotive grade electronic components to a minimum, with very limited interest in entering the market among component vendors catering to handsets and computers.

The Battery Electric Vehicle Drives Demand

Three types of electric vehicles are helping countries meet emission standards. These include hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEV). While each drivetrain employs a more advanced capacitive solution, it is the BEV that requires the largest volume of high voltage MLCCs.

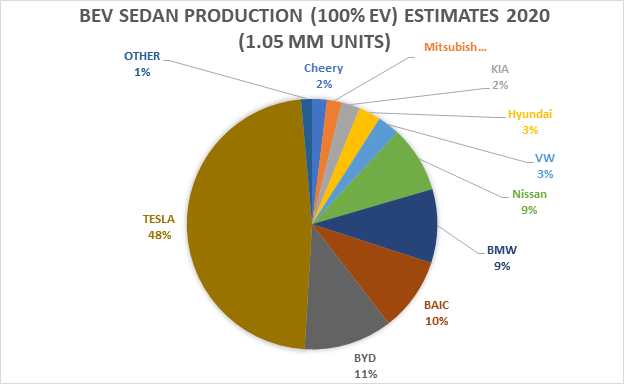

We estimate that for 2020, approximately one million sedan-type BEVs will be produced worldwide. Tesla will be the largest producer, accounting for about 48 percent of BEV global output from its factories in California and Shanghai. To date, Tesla is the only major player globally, with all other vendors now preparing bold moves in the market.

Two Chinese companies, BYD and BAIC, are Tesla’s closest competitors and account for 11 percent and 10 percent share, respectively. Tesla reported September quarterly production of 145,000 BEVs, up from 82,000 in the June 2020 quarter, and is targeting an ambitious 170,000 vehicles for the December quarter to achieve an expected output of 500,000 units for the year.

Figure 1: Battery Operated Vehicle (BEV) Production Estimates, 2020

Source: Paumanok Publishing estimates for this article. BEV sedan products only; excludes all Class 7 and 8 vehicles, scooters and bicycles. “Other” includes GM, Audi, Jaguar, Porsche, Mercedes, Ford, Rivian, Polestar and Great Wall.

The outlook for BEV Sedan production remains robust, with an average annual growth rate of 20 percent per year predicted until 2025 to meet stringent emission standards by country. Tesla is currently building 2 new factories in Germany and 5 new factories in the United States.

Technical Requirements for MLCCs in Battery Electric Vehicles

MLCCs consumed in battery electric vehicles must be of high-quality construction and operate at high voltages ranging from 250V to 4kV. Ceramic MLCCs are the preferred choice for distributed capacitance because of their ability to withstand high temperatures. Plastic film capacitors based on polypropylene could also withstand the high voltages, but their construction does not allow them to perform reliability above 105 degrees C. Therefore, high voltage MLCCs have been the product of choice for BEVs to date.

MLCC Clusters in BEV

My research shows that there are four areas in the BEV market where high voltage MLCCs are consumed: inverters, DC/DC converters, onboard charger (OBC) and the battery management system (BMS).

MLCCs in the Onboard Inverter: The traction motor requires an onboard inverter which converts DC battery power to three-phase AC power. DC link capacitor systems are employed that use both plastic film capacitors along with high voltage MLCCs. This capacitor system solution is placed between the DC (battery) and AC (load) sides of the voltage inverter.

MLCCs in the Onboard DC/DC Converter: While larger voltages are required for propulsion, the air conditioner and the starter motor, an onboard DC/DC converter converts high battery voltages to 12V DC in order to operate the infotainment features of the passenger compartment. This DC/DC converter requires MLCCs for EMI filtering – specifically, high capacitance solutions at high voltage.

MLCCs in the Onboard Charger: The OBC is used in BEVs to charge the traction battery. This system also requires high voltage ceramic safety capacitors for EMI suppression and AC line filtering. Smoothing capacitors are used for power factor correction in the OBC, which also requires a DC link capacitor, which can be either ceramic or plastic film.

MLCC in BMS Circuits: High voltage MLCCs are consumed in the battery management system in BEV sedans as safety capacitors. High voltage MLCCs are used in BEVs to suppress unwanted EM and RF interference. High voltage Class Y capacitors are used at the high-voltage bus in the BMS, and Class X safety capacitors are used to protect each individual cell. MLCCs are preferred in this application because of the high temperatures and the small size of the printed circuit boards.

Outlook for MLCCs in Battery Electric Vehicles

According to published data from Murata and Taiyo Yuden, two of the world’s largest MLCC manufacturers, the TESLA Model 3 contains over 9,000 MLCCs and the Model S and Model X each have over 10,000 MLCCs. This number is expected to increase to an average of 16,000 MLCC per BEV by 2025.

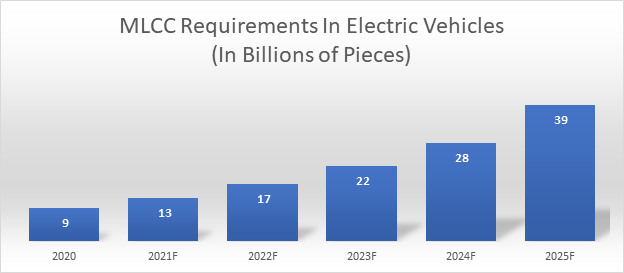

As BEV production is expected to rise at 20 percent per year through 2025, this would increase BEV sedan production from an estimated 1,050,000 units in 2020 to 2,612,000 units in 2025. The MLCC content in BEVs is expected to increase from 9,000 units per vehicle to 16,000 MLCCs per vehicle by 2025, with a forecast of 30,000 MLCCs per vehicle by 2030.

This creates a fast growth market for high voltage MLCCs, from an estimated 9.45 billion pieces in 2020 to almost 42 billion pieces by 2025. This is an average annual rate of growth of 36 percent per year over the next five years.

Figure 2: MLCC Unit Forecasts in BEVs, 2020-2025

Source: Paumanok MLCC Forecasts. Growth in the MLCC content per BEV (Battery Operated Sedan–Class 3 to 6) is based upon the MLCC data published by Murata and Taiyo Yuden showing the TESLA Model 3 containing over 9,000 MLCCs and the Model S & X each having over 10,000 MLCCs. The model for MLCC content per vehicle is an important growth multiplier, and is accelerated by the addition of ADAS (Autonomous Driving) which will increase MLCC content per vehicle by another 2,500 pieces.

Major vendors of automotive high voltage MLCCs for consumption in battery operated vehicles include AVX Corporation (a Kyocera subsidiary), Knowles Precision Devices, Murata Manufacturing, TDK Corporation, Taiyo Yuden, Vishay Intertechnology (Vitramon) and KEMET (a Yageo company).

The Materials Supply Chain for High Voltage MLCCs

Since capacitance is equivalent to the physical size of the finished capacitor, or the available surface area, raw materials (especially ceramic dielectric powders and electrode materials) play an important role in the variable costs associated with the production of MLCCs. High voltage MLCCs are unique because they require the ceramic layers to be thicker than normal. Also, automotive-grade MLCCs have historically been manufactured with palladium electrodes because of the high temperatures of under-the-hood operations.

High voltage safety capacitors have also been traditionally manufactured with palladium bearing electrodes. This is an opportunity for MLCC manufacturers who produce components with nickel electrodes. Recent breakthroughs in nickel electrode paste technology open the door for the development of higher-voltage base metal MLCCs.

Materials supply companies that will benefit from the increase in demand for high voltage MLCC materials include Ferro Corporation in the United States, which is known for its supply of ceramic dielectric formulations for high voltage MLCC production, and Shoei Chemical of Japan, known for its supply of palladium and silver electrode paste for high voltage MLCC applications.

Summary and Conclusions

The movement toward BEVs in Class 3 to 6 cars and light trucks is driving demand for high voltage MLCCs (250V to 4kV). The volume of MLCCs in the market-leading battery electric vehicles have 10,000 MLCCs per unit, concentrated in four clusters related to propulsion. The forecast is robust, with unit consumption expected to increase at a rate of 36 percent per year to satisfy increased BEV production and increased numbers of MLCCs per car.

Many component and materials vendors will be positively impacted by this net-new demand between 2021 to 2025, as various countries work to meet carbon emission goals by 2025.

Statements of fact and opinions expressed in posts by contributors are the responsibility of the authors alone and do not imply an opinion of the officers or the representatives of TTI, Inc. or the TTI Family of Companies.

Dennis M. Zogbi

Dennis M. Zogbi is the author of more than 260 market research reports on the worldwide electronic components industry. Specializing in capacitors, resistors, inductors and circuit protection component markets, technologies and opportunities; electronic materials including tantalum, ceramics, aluminum, plastics; palladium, ruthenium, nickel, copper, barium, titanium, activated carbon, and conductive polymers. Zogbi produces off-the-shelf market research reports through his wholly owned company, Paumanok Publications, Inc, as well as single client consulting, on-site presentations, due diligence for mergers and acquisitions, and he is the majority owner of Passive Component Industry Magazine LLC.