The Impact of The Smartphone on Consumer Electronics Products and Their Respective Component Supply Chains: 2013

06/19/2013 //

How the River has Changed Course:

It has become increasingly apparent over the past four years that the smartphone is displacing the need for additional consumer audio and video imaging products such as digital still and video cameras, portable gaming devices, MP3 audio players, GPS devices, alarm clocks, wristwatches, landlines and television sets. The impact on the supply chain for electronic components has been substantial.

Figure 1.1: Products that Used to be Purchased Separately now can be found in One Device - the Smartphone

.png)

Seven Supply Chains that have been Irrevocably Displaced by the Smartphone

In 2009 the general consensus was that demand for capacitors, resistors, inductors and other mass-produced passive electronic components would increase dramatically to support higher part counts in smartphones compared to traditional wireless handsets. But what was not apparent was how the smartphone would displace the component supply to other key platforms, especially those in the consumer audio and video imaging markets.

Portable Gaming:

Smartphone’s have been successfully and continually eroding new demand for portable gaming systems such as the Nintendo DS and the Sony PSP. The innovative developments in portable gaming have been muted for the past three years, with manufacturers largely dependent on software titles to generate interest in hardware, but due to the lackluster global economic environment, the masses have become more satisfied with iPhone® and Android® based gaming titles. The following chart illustrates the unit sales trend at Nintendo as an example of the impact smartphones are having on portable gaming.

Figure 1.2: Unit Sales of the Nintendo DS Portable Gaming Unit between FY 2009 and FY 2013 (In Millions of Units Sold Worldwide)

.png)

Source: Paumanok Publications, Inc. Compiled from Nintendo Annual reports. Based on fiscal year ending March 31 of each year.

Handheld GPS Devices:

Handheld portable GPS (Global Positioning System) devices such as TomTom, that are used for low cost, satellite based navigation systems for automobiles are also being eroded by smartphones. Software based applications such as iMotion®, coupled with internal GPS receivers in the phone enable a low cost, highly reliable smartphone GPS solution that does not require plug-in updates. The impact of Smartphones on portable GPS devices can best be summed up by the declining sales at TomTom as is shown below.

Figure 1.3: Revenues at TomTom- The World’s Leading Supplier of Portable Location and Navigation Products - CY 2008 to CY 2013 (In Millions of Euros)

.png)

Source: Paumanok Publications, Inc. Compiled from TomTom Annual reports. Based on a Calendar year. CY 2013 is forecast by TomTom.

Digital Still and Digital Video Cameras:

No end market has felt the crushing blow of smartphones on their unit production as have compact digital still cameras and handheld video cameras. The aggressive price cutting, ubiquitous marketing campaigns and the expansion of distribution channels by the top three manufacturers of cameras, Sony, Nikon and Canon, is having little impact on the encroachment of built-in smartphone cameras on the existing camera markets. And digital video cameras are also feeling the sting of the smartphone, as web based video sharing services such as Vine, continue to entice the younger generation to employ smartphones for visual communication. In Nikon’s annual report presentation materials released May 9, 2013 the company estimated that the compact digital camera market declined by 30% in unit sales worldwide in FY 2013. Also, Cisco’s discontinuation of its flip phone in April 2011 can also be directly traced to the success of the video feature on modern Smartphones.

MP3 Audio Players:

Another product market that has been practically wiped out by smartphones is the Mp3 player or the Portable Media Player (PMP). It can be argued that Apple launched the modern digital revolution with their release of the iPod more than a decade ago. Yet today, the desire for an iPod is displaced by the increased functionality of the iPhone, which is with the consumer at all times, and which offers the consumer greater access to more variety through the internet. The concept of product displacement through redundancy is most clear when we compare sales trend of Mp3 players and iPhones over time.

Figure 1.4: Unit Sales of the Apple Ipod® Portable MP3 Player: CY 2010-2013 (In Millions of Units Sold Worldwide)

.png)

Source: Paumanok Publications, Inc. Compiled from Apple, Inc. Annual reports. 2013 Unit sales for the iPod are extrapolated based on half year data provided by the company.

Alarm Clocks:

Instead of reaching for a broad plastic snooze button or (dare I say) a brass hammer atop brass bells, now the consumer must slide their finger across a capacitive touch screen, or press the too familiar touch screen red snooze button. What this means for the purposes of this story is that the traditional bedside radio alarm clock is rapidly fading into a thing of the past. The detailed alarm function of the Smartphone has made the radio alarm clock redundant and useless.

Figure 1.5: Global Import Value for Electrically Powered Alarm Clocks: 2010-2012 (Value in Millions of US Dollars)

.png)

Source: United Nations Trade Statistics- Global Imports for Alarm Clocks; Electrically Operated HTS#910511

Telephone Landlines:

According to the Federal Communications Commission (FCC) the number of households in the United States without landlines (or those that just use wireless phones) was 32% in June 2011 (the latest government data available). This has increased since 2004 when it was only 5% of U.S. households without landlines. Therefore, not only have smartphones had a major impact on net new sales of landline telephone sets (keysets), but also the copper wire infrastructure that supports these phones (i.e., subscriber line interface cards and telephone switches).

Figure 1.6: US Households Getting Rid of Traditional Landline Telephones

.png)

Source: 2004 and 2007 Data from the Associated Press; 2011 Data from the FCC.

Smartphone Impact on the Component Supply Chain:

The success of the Smartphone in the global economy and its negative impact on specific consumer audio and video imaging products have been shown in this MarketEYE article; however, the impact on component revenues has also been equally daunting, and represents a trend that will continue.

For years, the consumer audio and video imaging end use product market dominated the revenues of the passive electronic component industry, however, between 2009 and 2013 this trend has changed, and now the telecommunication sector, with emphasis on component demand from the smartphone segment bow dominates global component revenues. This article explains how the component supply chain shifted away from consumer audio and video imaging products as the success of the smartphone and its plethora of functions made additional audio and video imaging products redundant.

TDK Corporation: Change in Passive Component Sales to the Telecom and Consumer AV Sector:

The following chart illustrates a significant change in revenues at TDK Corporation, the world’s largest producer of passive components, with major competitive positions in capacitors and discrete inductors; based on shipments to the telecommunications segment versus the consumer AV end-use market segment. The reader will not how sales of passive components to the consumer AV end use market segment declined by a collective 37.5% between FY 2009 and FY 2013, while passive component sales to the telecommunications end-use market segment increased by 66.5% during the same time period.

Figure 1.7: Changes in Revenues Derived from the Telecom and Consumer AV End-Use Market Segments At TDK Corporation

.png)

Source: Compiled by Paumanok Publications, Inc. from TDK financial presentation; FY 2014 forecast created by Paumanok from TDK guidance.

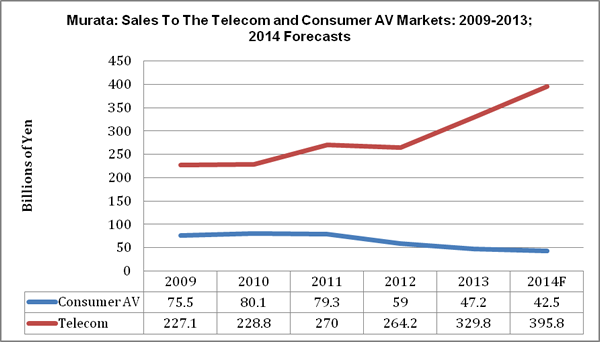

Murata Manufacturing Limited: Change In Passive Component Sales to the Telecom and Consumer AV Sector:

Murata Manufacturing Limited, the world’s second largest manufacturer of passive components and the world’s largest capacitor manufacturer also shows a similar trend-line with respect to sales by end-use market segment at their company. Revenues derived from the telecommunications end-use market segment have increased by 45.2% between FY 2009 and FY 2013, and are forecast by Murata to grow 20% in FY 2014, while revenues derived from the consumer audio and video imaging end-use market segment have declined by 37.5% during the same time period, and are forecast by Murata to decline again in FY 2014 by an additional 10% year-over-year.

Figure 1.8: Changes in Revenues Derived from the Telecom and Consumer AV End-Use Market Segments At Murata Manufacturing Company Limited

Source: Compiled by Paumanok Publications, Inc. from Murata financial presentations and annual reports; FY 2014 forecast by end-use market segment is generated by Murata Manufacturing.

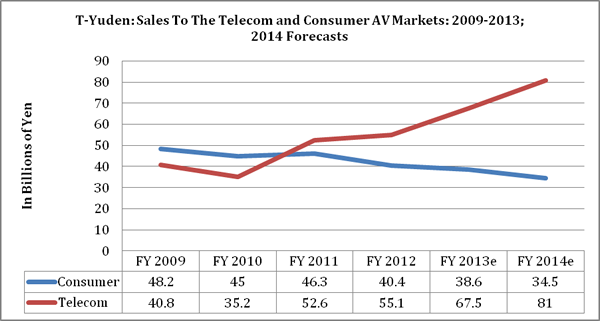

Taiyo Yuden: Change in Passive Component Sales to the Telecom and Consumer AV Sector:

Taiyo Yuden Company Limited of Japan, which is also one of the world’s top passive component manufacturers with major competitive positions in capacitors and discrete inductors, also has demonstrated a significant shift in revenues derived from the telecommunications end-use market segment when compared to revenues derived from the consumer audio and video imaging send-use market segment. Revenues derived from the consumer AV end-use market segment at Taiyo Yuden for example, declined by 19.9% between FY 2009 and FY 2013, and revenues derived from the telecommunications end-use market segment increased by 65.4% during the same time period. Continued growth in the telecommunications end-use market segment is expected for FY 2014 at Taiyo Yuden, and at the continued expense of revenues derived from the consumer AV end-use market segment.

Figure 1.9: Changes in Revenues Derived from the Telecom and Consumer AV End-Use Market Segments At Taiyo Yuden Company Limited

Source: Compiled by Paumanok Publications, Inc. from Taiyo Yuden Company Limited financial presentations and annual reports; FY 2013 is estimated based upon half year revenues data by end-use market segment at Taiyo Yuden. FY 2014 forecast by end-use market segment estimated by Paumanok Publications, Inc.

Summary and Conclusion:

This MarketEYE article establishes there is a significant trend that has been occurring since 2009 that the rise and global acceptance of the smartphone has had a negative impact on six traditional technology platforms and their component supply chains. Over time, we expect that additional end-use product markets may also be negatively affected by the smartphone including, but not limited to remote controls, car stereos and smaller television sets, which can be considered redundant when faced with ubiquitous, ever-improving smartphone technology.

Dennis M. Zogbi

Dennis M. Zogbi is the author of more than 260 market research reports on the worldwide electronic components industry. Specializing in capacitors, resistors, inductors and circuit protection component markets, technologies and opportunities; electronic materials including tantalum, ceramics, aluminum, plastics; palladium, ruthenium, nickel, copper, barium, titanium, activated carbon, and conductive polymers. Zogbi produces off-the-shelf market research reports through his wholly owned company, Paumanok Publications, Inc, as well as single client consulting, on-site presentations, due diligence for mergers and acquisitions, and he is the majority owner of Passive Component Industry Magazine LLC.