CY 2012 North American Relay Market Sales Down 11% and Bookings 8% Lower than 2011

05/15/2013 //

Total reported sales for all relay categories in North America for the fourth quarter of 2012 were 15% lower than reported in the previous quarter and 8% below the same quarter of 2011. Sales units for Q4’12 came in 6% lower from Q3 and 22% less than Q4’11.

The total booking dollars reported for all relay types in North America for Q4’12 were less than the previous quarter by 21%, and higher than Q4 2011’s total bookings by 6%. The fourth quarter’s book-to-bill ratio for dollars was 0.918. Booking units in Q4’12 ran 18% below Q3. The fourth quarter’s book-to-bill ratio for units was 0.864.

The fourth quarter of 2012 saw sales were down in dollars, units, and ASP for EMRs and SSRs compared to Q3. In total dollars decreased over 15% while units were 6% lower and the ASP moved down 9%. Comparisons to the same quarter last year show both units and dollars down for EMR and while SSR had an increase in dollars. In total dollars fell 8%, units dropped 12%, as the ASP moved 12% higher. For 2012 compared to 2011 EMRs are down in both dollars and units while SSR dollars have increased. In total dollars are 11% lower with units down 22% and selling prices up 14%.

Sales Growth by Relay Categories

|

Q4 Versus Q3 CY 2012 |

Q4 2012 Versus Q4 2011 |

CY 2012 Vs. 2011 |

||||||

Category |

Dollars |

Units |

ASP |

Dollars |

Units |

ASP |

Dollars |

Units |

ASP |

Electro-mechanical |

-14.4% |

-5.6% |

-9.3% |

-9.5% |

-12.2% |

3.1% |

-12.4% |

-22.1% |

12.4% |

Solid State |

-23.7% |

-22.6% |

-1.5% |

3.5% |

-18.4% |

26.7% |

5.9% |

-13.5% |

22.4% |

Total |

-15.3% |

-6.4% |

-9.5% |

-8.5% |

-12.5% |

11.9% |

-10.8% |

-21.7% |

14.0% |

Bookings moved lower in Q4 compared to Q3 for all measures except SSR ABP. In total booking dollars and units have moved down 21% and 18%. The ABP for EMRs slipped just over 4% while SSRs rose 13%. The comparison to Q4’11 shows dollars and units up for EMRs and down for SSRs. The ABP for EMRs fell over 18% while SSRs moved up more than 10%. Year end totals compared to the previous year dollars down 8% and units off by 14% and total ABP up 6%.

Bookings Growth by Relay Category

|

Q4 Versus Q3 CY 2012 |

Q4 2012 Versus Q4 2011 |

CY 2012 Vs. 2011 |

||||||

Category |

Dollars |

Units |

ABP |

Dollars |

Units |

ABP |

Dollars |

Units |

ABP |

Electro-mechanical |

-21.2% |

-17.5% |

-4.5% |

11.1% |

36.4% |

-18.5% |

-7.8% |

-13.2% |

6.2% |

Solid State |

-18.2% |

-27.4% |

12.7% |

-22.4% |

-29.8% |

10.5% |

-11.3% |

-19.3% |

9.8% |

Total |

-20.9% |

-18.0% |

-3.8% |

6.4% |

31.3% |

-18.9% |

-8.3% |

-13.6% |

6.1% |

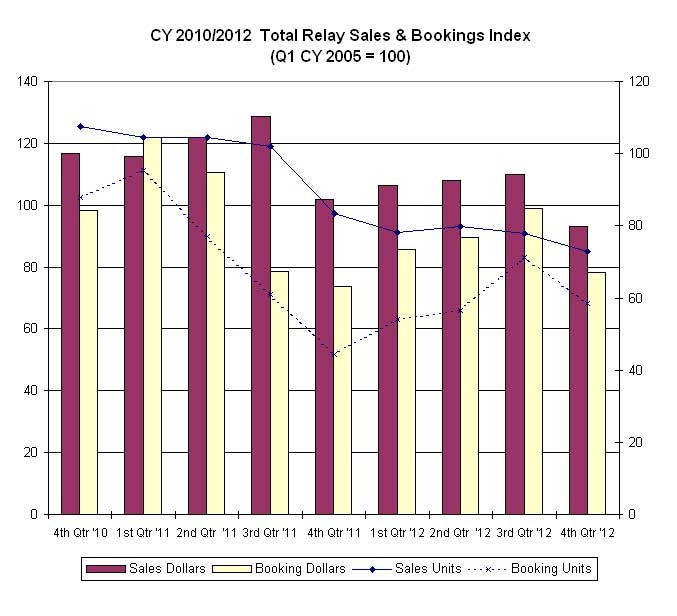

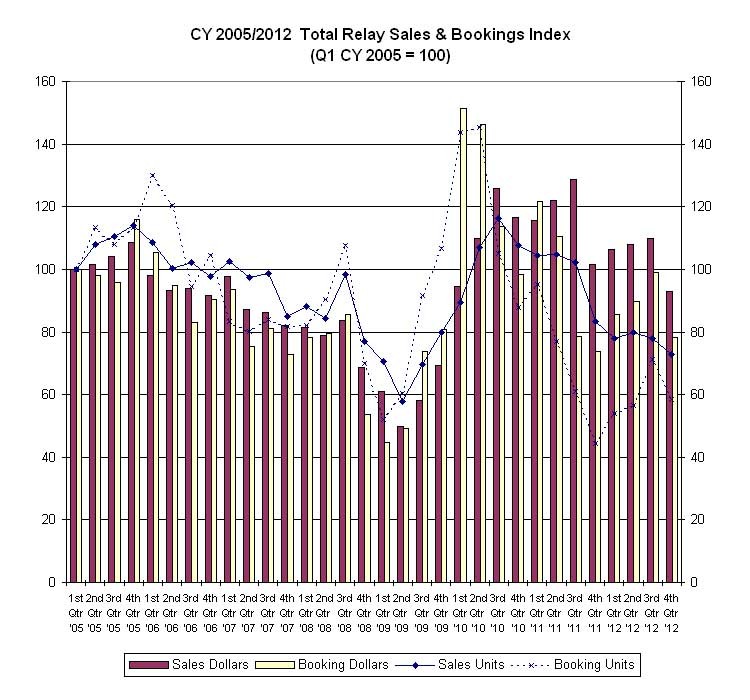

The graph below shows total quarterly indexed sales and bookings in dollars and units for the reported data. Sales dollars and units were relatively flat from Q4’10 through Q3’11. Since then, sales dollars and units took a step down in Q4’11 but have increased some the first three quarters of 2012 only to fall in the last quarter. Booking dollars and units set an all time high in Q1 and Q2’10. Since then they have trended lower reaching a low Q4’11 and, like sales, recovered in the first three quarters of 2012 but falling in the last. The second graph of indexed sales and booking shows bookings units at the lowest level ever measured in Q4’11.

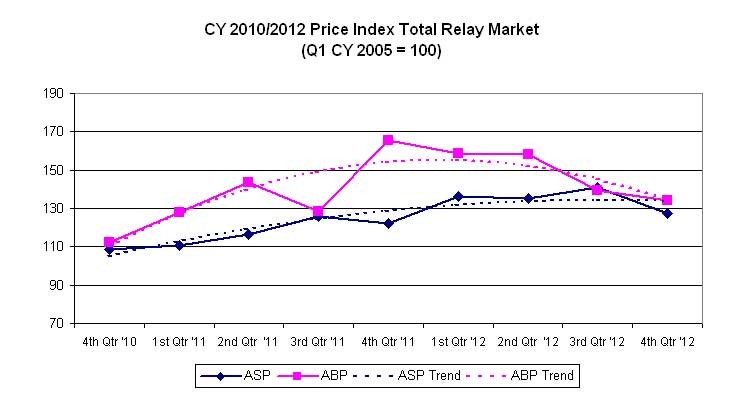

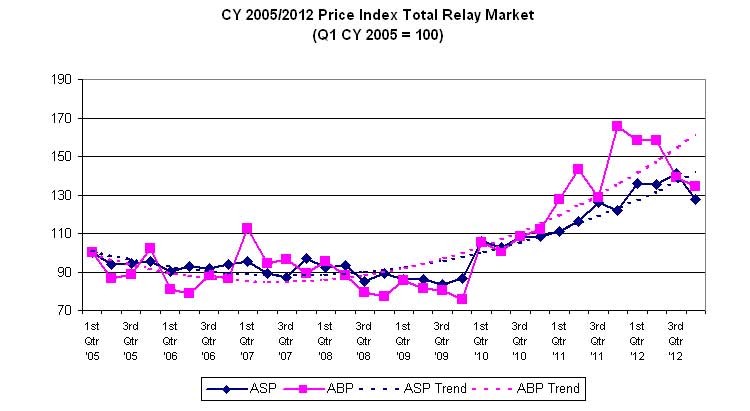

The overall indexed selling prices have moved higher 25% to a peak in Q3 last year then dropped 10% in Q4. Booking prices jumped 50% to a high Q4’11 and have fallen since. The second graph of indexed selling and booking prices shows both remain at or near Relay Report highs.

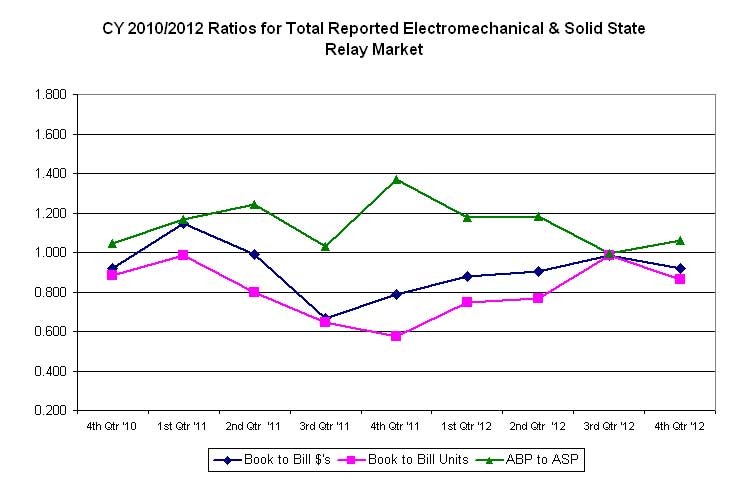

Book-to-bill dollars and units trended down to two year lows in Q3 and Q4’11, then came back up to be near 1.0 in Q3 of last year and then moved lower. The ratio of average booking to selling prices has general moved higher to peak in Q4’11, moved lower until recovering some in Q4 last year.

Michael Schwert

Michael is the founder of Cumulus, Inc. He has more than 30 years of marketing and sales as well as design experience in the electronic and electrical component industry. Prior to founding Cumulus, he was Director of Marketing for Cherry Electrical Products and held other marketing management positions with Panduit, BRK Electronics, and Ideal Industries.

Cumulus provides market information and consulting services for the global electronic components industry. The company offers three publications: Switch Tracks, a quarterly report with market information on component switches; the Relay Report, a quarterly report with market information on component relays; and Market Notes, a monthly report on sales, bookings, and business conditions in the relay and switch market. Cumulus also manages projects that help leading global suppliers in the relay and switch industry to develop new products and reach new markets.

Schwert provides MarketEYE with monthly articles that include timely and accurate market information for the electromechanical component sector of the electronics industry.