North American Switch Market Ends First Three Quarters of 2014 with Sales Down 1%& Bookings 4% Lower than Q1 2013

02/03/2015 //

Total reported sales for all switch categories in North America for Q3’14 were 1% more than the previous quarter and 5% below the third quarter of 2013. Sales units for Q3’14 was 9% below units sold in Q2’14 and 12% less than Q3’13.

The total booking dollars reported for all switch categories in North America for Q3’14 ran 1% lower than the previous quarter and below Q2’13’s total bookings by 1%. The first quarter’s book-to-bill ratio for dollars was 0.983. Booking units in Q3’14 were down 12% from Q2. The first quarter’s book-to-bill ratio for units was 0.910.

The third quarter versus the second showed total sales dollars inched up 1% and units 9% lower. This was driven by decreases in DIP, snap action, and toggle switches. Six of eight switch categories realized lower unit sales. Prices were up 10% in total with over half the categories improving. The comparison to the third quarter of 2013 yielded similar results dollars down in five of eight categories and 5% in total. Units were also down for over half the categories and lower in total by 11%. Pricing from a year ago was up in four of eight categories and in total by 7%. Year to date versus a year ago has dollars lower by 1% in total with losses in all but two categories. All in, units improved 6% with most categories up. The ASP lost 7% with all but one category down.

Sales Growth by Switch Category

| Q3 2014 Versus Q2 2014 | Q3 2014 Versus Q3 2013 | YTD CY2014 Versus. YTD CY 2013 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Category | Dollars | Units | ASP | Dollars | Units | ASP | Dollars | Units | ASP |

| DIP | 3.9% | 9.0% | -4.7% | 30.7% | 70.3% | -23.3 | 29.6% | 52.6% | -15.2% |

| Keylock | -10.4% | -1.9% | -8.6 % | -43.3% | -30.6% | -18.4% | -21.9% | -18.7% | -3.4% |

| Push Button | -7.8% | -22.9% | 19.6% | 8.9% | 3.6% | 5.2% | -0.4% | 3.0% | -3.3% |

| Rocker | -2.2% | -4.4% | 2.2% | -6.5% | -13.4% | 8.0% | 1.8% | 0.7% | 1.1% |

| Slide | -0.7% | -5.4% | 4.9% | -10.7% | -4.4% | -6.5% | -3.7% | 4.5% | -7.8% |

| Snap Action | 6.5% | -5.6% | 12.7% | -9.3% | -34.4% | 38.3% | -2.4% | -18.7% | 18.2% |

| Tact | -6.4% | -15.1% | 10.3% | -13.3% | -15.2% | 2.2% | -11.1% | 5.2% | -16.1% |

| Toggle | 2.7% | 6.6% | -3.7% | 3.9% | 17.9% | -11.9% | -9.4% | 4.5% | -13.3% |

| Total | 0.7% | -8.6% | 10.1% | -5.4% | -11.4% | 6.8% | -1.4% | 5.6% | -6.8% |

When compared to last quarter total booking dollars and units decreased. Dollars were down in five of eight types and units lower in six categories . Booked prices were up in most categories and 11% in total. Booked dollars in Q3 against the same quarter of 2013 were down for half the types and in total by 1%. Units were up for half of the categories and but down 18% in total driven by snap action and tact switches. Prices were up for five of the eight categories and increased 20% higher on the strength of snap action and tact categories . Bookings year to date versus 2013 were down in total dollars, units and price. Dollars are down 4% with losses in half of the categories . Units were off by 2% and in most of the categories . Booking price slipped 3% with over half the types down.

Bookings Growth by Switch Category

| Q3 2014 Versus Q2 2014 | Q3 2014 Versus Q3 2013 | YTD CY2014 Versus YTD CY 2013 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Category | Dollars | Units | ABP | Dollars | Units | ABP | Dollars | Units | ABP |

| DIP | -4.6% | -6.7% | 2.2% | 32.9% | 70.6% | -22.1% | 30.2% | 56.8% | --17.2% |

| Keylock | -11.2% | -26.6% | 21.0 % | -11.5% | -17.2 | 6.9% | -16.5% | -20.5% | 5.3% |

| Push Button | 11.4% | 3.7% | 7.4% | 17.3% | 5.2% | 11.5% | 0.6% | -16.2% | 18.8% |

| Rocker | 17.3% | -0.9% | 18.3% | 20.4% | 8.3% | 11.1% | 7.9% | 2.4% | 5.2% |

| Slide | -28.4% | -33.6% | 7.8% | -25.9% | -23.8% | -2.8% | -1.7% | 11.8% | -13.3% |

| Snap Action | -5.8% | -7.1% | 1.4% | -19.8% | -30.1% | 14.7% | -14.8% | -23.5% | 9.3% |

| Tact | -22.2% | -13.1% | -10.5% | -22.2% | -27.0% | 6.6% | -17.2% | -13.2% | -6.0% |

| Toggle | 9.3% | 40.6% | -22.2% | 37.1% | 53.8% | -10.9% | 8.4% | 17.6% | -7.6% |

| Total | -1.5% | -11.6% | 11.4% | -0.9% | -17.8% | 20.5% | -4.2% | -2.4% | -2.8% |

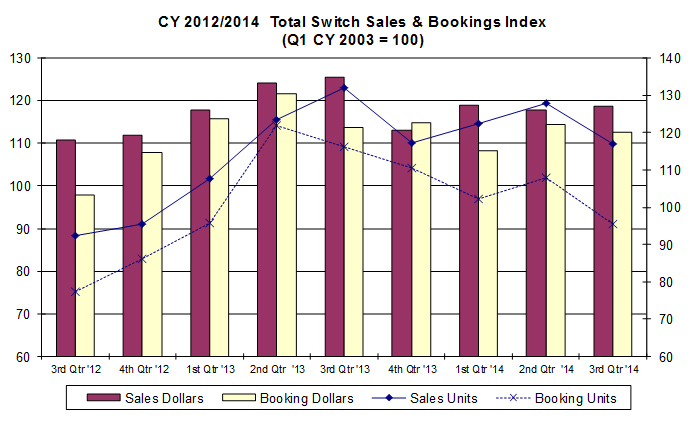

The graph below shows total quarterly indexed sales and bookings in dollars and units for the reported data since Q3 CY’12. All measures set two-year highs Q2 and Q3’13 and had been improving over the previous three quarters. In Q3’13, sales measures continued to improve as booking measures eased down the next three quarters and improved in Q2 of this year. Sales measures dropped in Q4 of last year but rebounded in Q1’14 only to slip in Q2 and Q3.

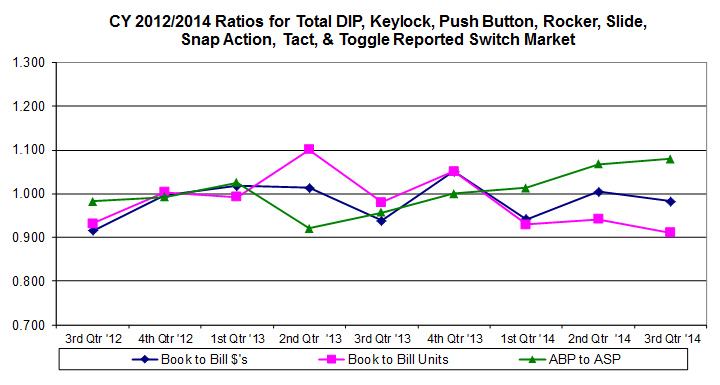

Book-to-bill units have generally trended higher until Q3 of last year when then have trended lower. Book-to-bill dollars have oscillated above and below 1.0 over the last two years. The booking to selling price ratio had been trending lower until reversing in Q3’13 and is now above 1.0 for the last three quarters.

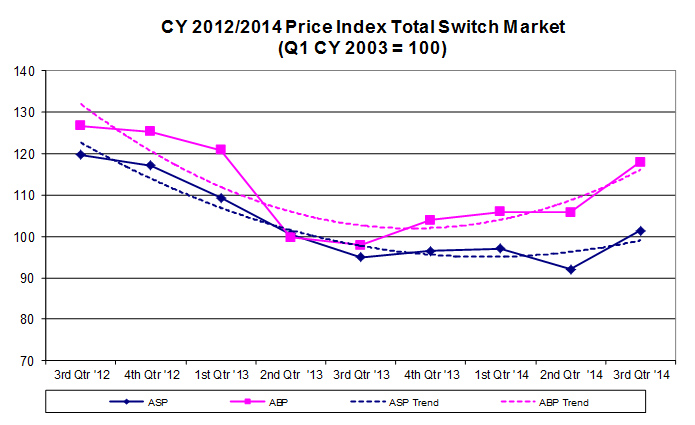

Indexed booking prices peaked in 2012 and trended lower until moving higher the last four quarters. Indexed selling prices reached an apex Q3’12 then moved mostly lower and may now be heading higher.

Michael Schwert

Michael is the founder of Cumulus, Inc. He has more than 30 years of marketing and sales as well as design experience in the electronic and electrical component industry. Prior to founding Cumulus, he was Director of Marketing for Cherry Electrical Products and held other marketing management positions with Panduit, BRK Electronics, and Ideal Industries.

Cumulus provides market information and consulting services for the global electronic components industry. The company offers three publications: Switch Tracks, a quarterly report with market information on component switches; the Relay Report, a quarterly report with market information on component relays; and Market Notes, a monthly report on sales, bookings, and business conditions in the relay and switch market. Cumulus also manages projects that help leading global suppliers in the relay and switch industry to develop new products and reach new markets.

Schwert provides MarketEYE with monthly articles that include timely and accurate market information for the electromechanical component sector of the electronics industry.