And the Survey Says… Growth Ahead for 2013

01/09/2013 //

Each year in the fourth quarter TTI sends out a survey to all of the manufacturer’s reps we work with in North America. The purpose of the survey is to find out what distributor service elements are most important to the reps, how we are performing on those elements, and how we measure up to our competitors. At the end of the survey we also ask the reps for their outlook on business for the year to come.

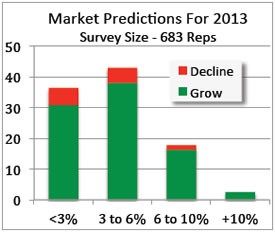

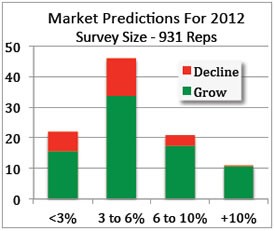

Specifically, the survey asks reps whether they think their business is going to grow or decline, and for either answer, by how much. There are four ranges to chose from: (1) less than 3%, (2) 3% to 6%, (3) 6% to 10%, and (4) more than 10%. The two charts below show the results from the hot-off-the-press 2012 survey and, for reference, the 2011 survey.

For 2013, a greater percentage of reps surveyed (38%) believe their business will grow 3% to 6% in the New Year. When we added in the reps who believe their business will grow 0-3% that brings the total to 69% of the reps who were surveyed. In other words, two thirds of the rep community feels their business in 2013 will grow as much as 6% this year. That is very encouraging and is in line with current predictions for U.S. GDP growth, which is in the low 2% range. Historically our industry tends to grow at twice the rate of GDP.

For the minority of reps (11%) who believe their business will decline in 2013, they clumped in the sub 6% range. So as a community they are bookending sales change for the year at plus-or-minus 6%, with the strong majority betting on growth.

How accurate a data point is this? Difficult to say with precision though evidence from past surveys suggests that reps are pretty good at ball parking the New Year outlook.

As mentioned, the results from the 2011 survey are included for reference. For 2012, 50% of reps believed their business would grow up to 6%, and 19% felt that their business would decline by up to 6%. So last year reps set the bookends in about the same place as this year’s survey. But it is clear when comparing the two surveys; reps were feeling more bearish when they took the survey in Q4 2011.

How did they do? Do you think that when the ink dries on 2012 we will find that the electronic components industry has grown in the low single digits? If so, that suggests reps have a good feel for the near business future and based on that feel, we should have a little bit better year in 2013. Fingers crossed!

Michael Knight

Michael Knight is President of TTI Semiconductor Group and Senior Vice President of Corporate Business Development for TTI, Inc. He has over 25 years of experience in the electronics field and is noted for his knowledge of worldwide industry trends and challenges.